RALEIGH, N.C. — Vice President Kamala Harris traveled to Raleigh, North Carolina Monday to talk about helping small businesses gain access to capital. She also highlighted the record-breaking growth of small businesses in the U.S. over the last two years.

The federal government loaned North Carolina’s Latino Credit Union $99 million, making it possible for the credit union to give many more small businesses access to capital to grow, said Vicky Garcia, a senior vice president with the credit union.

Garcia joined Harris and Isabella Guzman, head of the Small Business Administration, to talk about the Community Development Financial Institution Fund and other programs.

Community banks, the vice president said, are key to building small businesses because they understand the community. “They sit down and take the time, because they understand the value of the people sitting across the desk,” Harris said.

“Small businesses employ half of our nation’s workforce,” she said. "They are contributing to the economic health of our nation in a profound way.”

Harris said that more small businesses have been created in the past two years than at any time in the history of the United States. A recent Census report found that more than 10 million new businesses were created in the past two years.

Access to capital can be critical to helping those small businesses grow and employ more people, Garcia said. Getting those loans or lines of credit can be hard for traditionally underserved communities.

She gave an example of a house painter who has four or five employees and is doing steady business. If that house-painting company gets a big new contract, they may need a loan to buy more equipment like ladders, and hire more people.

The role of the Durham-based Latino Credit Union is to give that small business owner a loan so they can get the next big contract and grow their business. She said the credit union also started a mortgage program so their customers can buy homes and continue to invest in the community.

“Latinos have come to North Carolina, they want to buy houses as well, they want to participate in the community,” Garcia said.

The SBA and the Community Development Financial Institutions Fund have been working with local financial institutions to get more capital available for small business loans. Guzman said the SBA sends out $40 to 50 billion a year to help give small businesses access to credit and capital.

“We’re really trying to make sure the smallest of the small businesses have access to capital,” Guzman said.

"In the president's first year, $450 billion was disbursed around the country," the SBA administrator said. "And we got it into the hands of those left out previously, into the hands of the smallest of the small businesses."

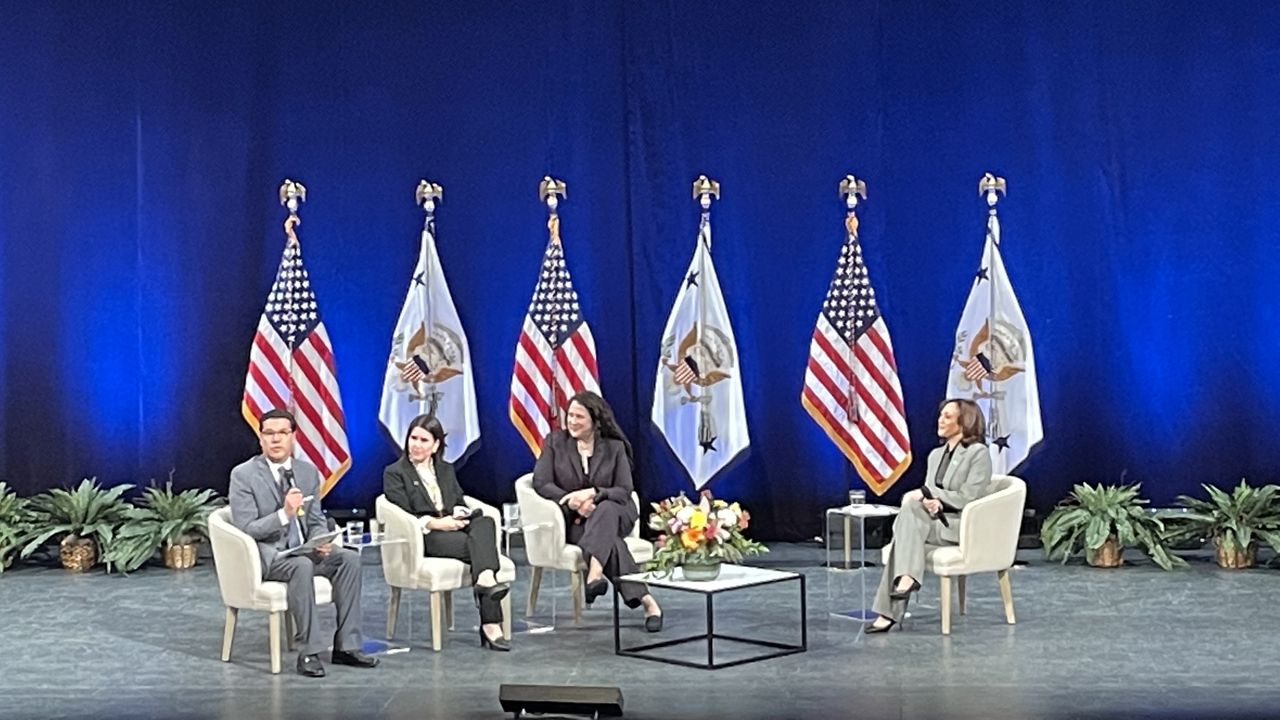

Harris, Guzman and Garcia spoke Monday at the A.J. Fletcher Theater in downtown Raleigh, North Carolina, in a discussion moderated by Jorge Buzo, a journalist with the local Univision station.

After Harris left the Performing Arts Center, she stopped by Panadería Artesana, a Latina-owned bakery in Raleigh with 17 employees, according to pool reports. Owner Jessica Barahora got her start with a loan from the Latino Credit Union.

The vice president took a quick tour of the bakery before Barahora helped Harris pick out a tray of baked goods to take along for the trip back to Washington D.C., according to the press pool.