RALEIGH, N.C. (AP) — North Carolina state government is seeking to rid potentially billions in medical debt from low- and middle-income residents by offering a financial carrot for hospitals to take unpaid bills off the books and to implement policies supporting future patients.

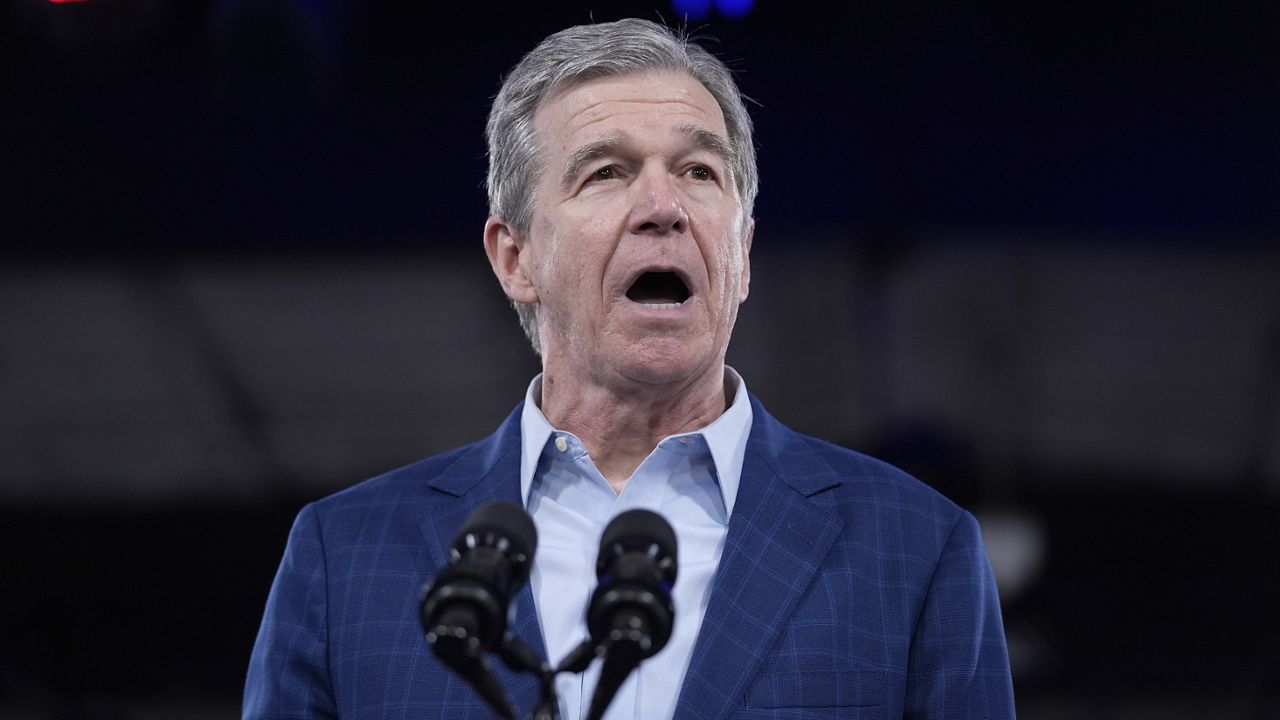

Democratic Gov. Roy Cooper's administration unveiled Monday a plan it wants federal Medicaid regulators to approve that would allow roughly 100 hospitals that recently began receiving enhanced federal Medicaid reimbursement funds to get even more money.

But to qualify an acute-care, rural or university-connected hospital would have to voluntarily do away with patients' medical debt going back ten years on current Medicaid enrollees — and on non-enrollees who make below certain incomes or whose debt exceeds 5% of their annual income.

Going forward, these hospitals also would have to help low- and middle-income patients — for example, those in a family of four making no more than $93,600 — by providing deep discounts on medical bills incurred. The hospitals would have to enroll people automatically in charity care programs and agree not to sell their debt to collectors or tell credit reporting agencies about unpaid bills. Interest rates on medical debt also would be capped.

Cooper said the plan has the potential to help 2 million people in the state get rid of $4 billion in debt, much of which hospitals are never going to recoup anyway.

"Large medical bills from sickness or injury can cripple the finances of North Carolinians, particularly those who are already struggling,” Cooper said in a news release. “Freeing people from medical debt can be life-changing for families, as well as boost the overall economic health of North Carolina.”

Other state and local governments have tapped into federal American Rescue Plan funds to help purchase and cancel residents' debt for pennies on the dollar. North Carolina's proposed initiative would be different by creating a long-term solution to debt, state Health and Human Services Secretary Kody Kinsley said.

“We really wanted to create a more sustainable path forward and not just be one-and-done, but to keep it going,” Kinsley said in an interview.

North Carolina legislators last year created the enhanced Medicaid reimbursement payments for hospitals — called the Healthcare Access and Stabilization Program —alongside provisions that expanded Medicaid coverage in the state to working adults who couldn't otherwise qualify for conventional Medicaid. More than 479,000 people already have enrolled for the expanded Medicaid offered since last December.

Cooper’s proposal doesn’t require a new state law and won’t cost the state any additional funds, but the U.S. Centers for Medicare and Medicaid Services must approve the Healthcare Access and Stabilization Program changes. Kinsley said he believes regulators will be “aggressive in their approval.” Cooper’s administration wraps up at year’s end, since he’s barred by term limits from reelection.

To sweeten the deal, the financial possibilities for hospitals in the debt program that agree to debt alterations appear rich. The state Department of Health and Human Services said hospitals that choose to participate would be eligible to share funds from a pot of up to $6.5 billion for next year. Those who don't can share from $3.2 billion.

The effort also will depend on the willingness of the state's hospitals to participate. Kinsley said he didn't know where the North Carolina Healthcare Association — which lobbies for non-profit and for-profit hospitals — stands on the effort, and that it wouldn't participate in a public announcement later Monday.

And the debt relief wouldn’t begin right away, with consumers benefitting in 2025 and 2026, according to state DHHS.

Republican State Treasurer Dale Folwell has questioned the commitment of the state's largest nonprofit hospital systems to treat patients who are poor at free or reduced rates. The N.C. Healthcare Association has pushed back at Folwell, promoting their members' charity-care efforts and other contributions to communities they serve.

A group called Undue Medical Debt that's assisted other governments with cancelling medical debt, also would work on North Carolina's effort, DHHS said.