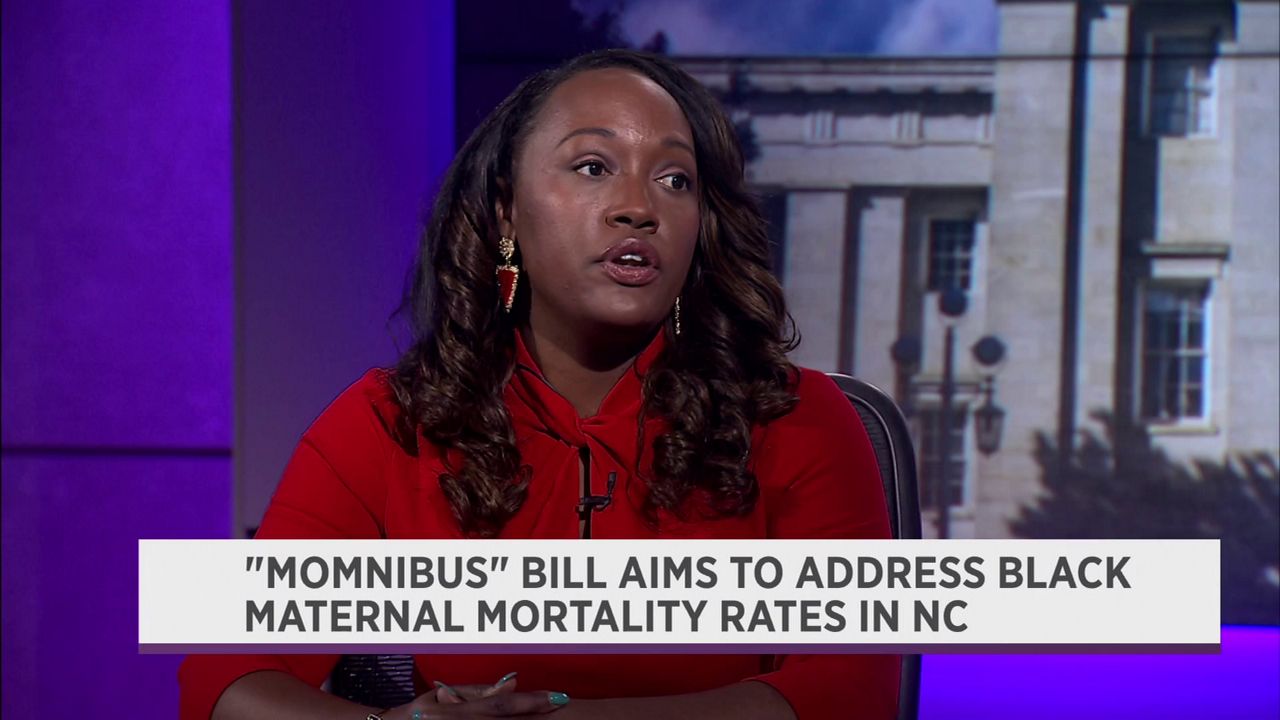

RALEIGH, N.C. — Gov. Josh Stein has announced his 2025-27 state budget proposal, outlining a $67.9 billion spending plan focused on education, workforce development, health care and public safety.

The proposal, which Stein calls a budget that “reflects North Carolina’s values,” aims to invest in key areas while freezing planned tax cuts to avoid an anticipated $800-million shortfall in the coming years.

Here are key highlights of Stein’s budget proposal.

Education: More funding for schools and teacher raises

Stein is calling for over $14 billion for education for each of the next two years, with a strong emphasis on teacher pay and school infrastructure. His plan includes:

- A 10.7% average pay increase for teachers over two years, making North Carolina’s starting teacher salary the highest in the southeast

- A $4 billion bond to improve school buildings, addressing aging infrastructure and crowded classrooms

- Hiring more school counselors, nurses and social workers to provide student support services

- Free breakfast for all public school students, ensuring children start the day with a meal

Stein also proposes phasing out the Opportunity Scholarship program, or school vouchers, and redirecting the money toward public education. The voucher program has the support of the Republican majority in the General assembly.

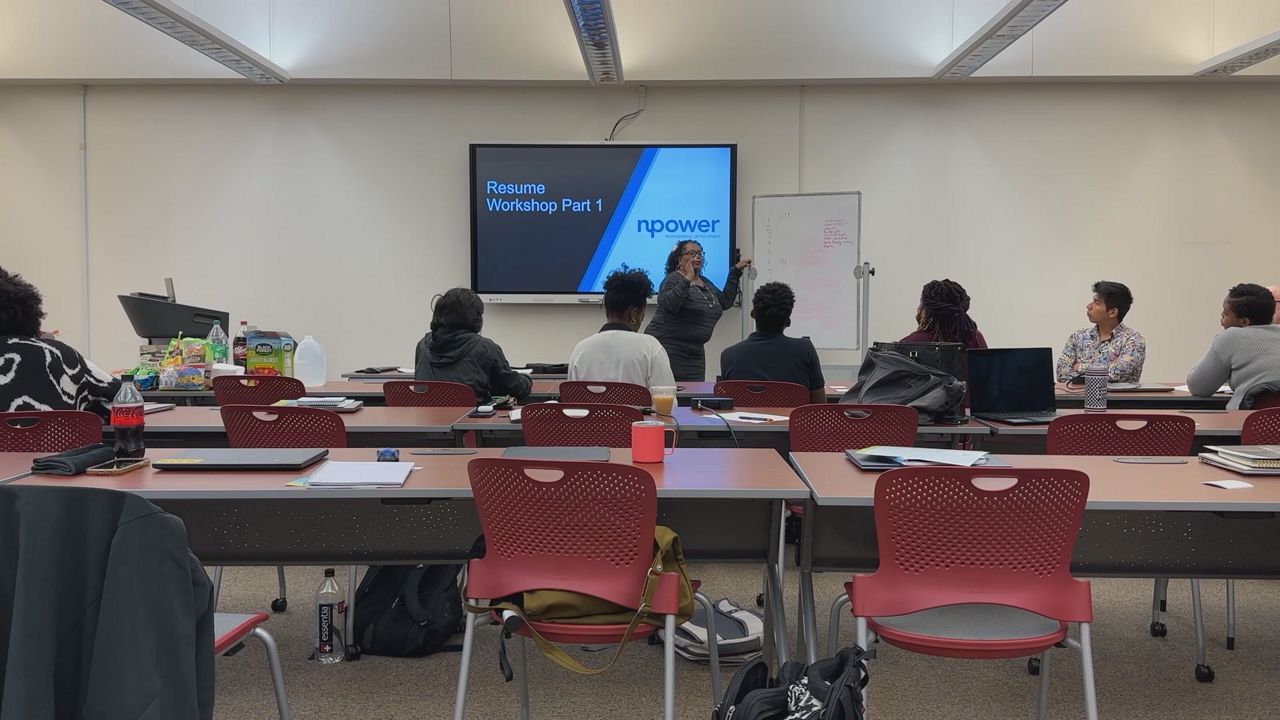

Workforce development and tax relief

To strengthen North Carolina’s workforce, the budget proposes:

- Free community college for students entering high-demand industries like health care and information technology

- Expanding apprenticeship programs, particularly in rural areas

- New tax credits for middle- and low-income families, potentially providing up to $1,600 to some families

While Stein is pushing for tax relief for working families, his plan freezes the scheduled corporate and personal income tax cuts, keeping the individual tax rate at 4.25% and the corporate tax rate at 2.25% to maintain state revenue. Stein warns his budget office forecasts the state is facing an $800 million revenue shortfall in two years.

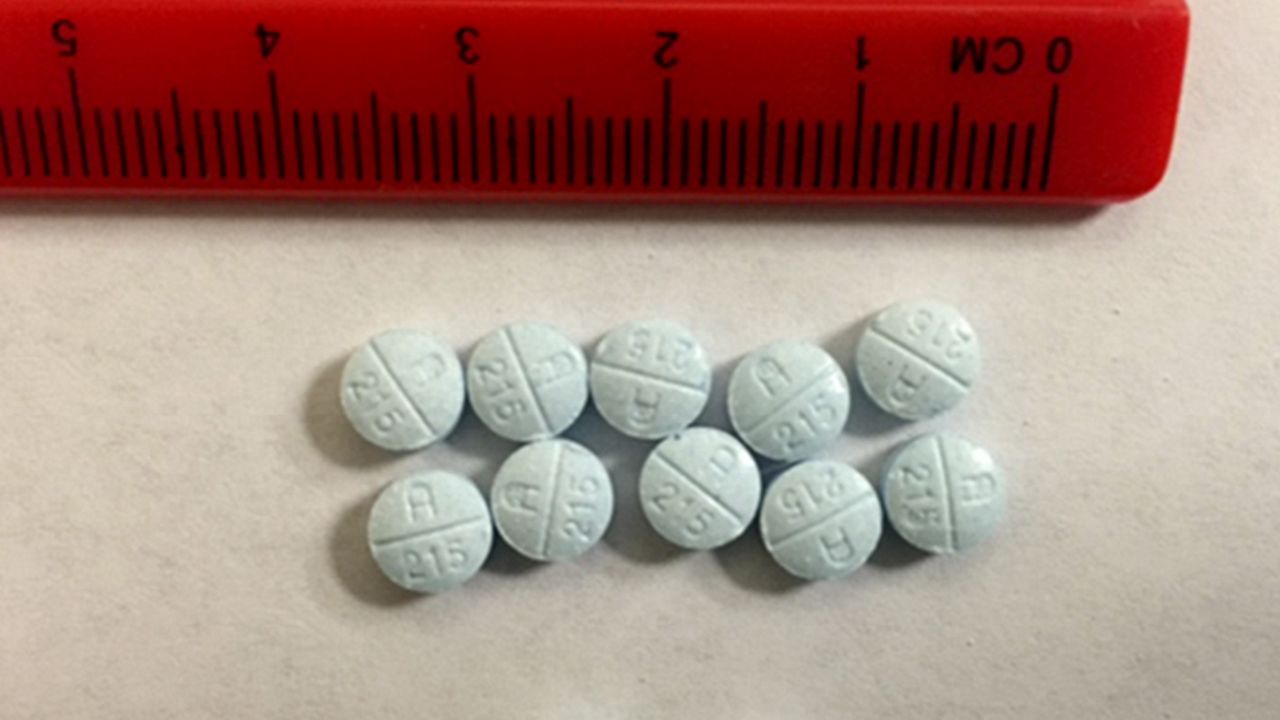

Public safety and the opioid crisis

The proposal also aims to recruit and retain law enforcement officers by:

- Raising salaries for state law enforcement officers, including correctional officers and youth counselors

- Offering signing bonuses for new hires and out-of-state transfers

- Expanding resources for the fentanyl crisis, including a new fentanyl control unit to crack down on trafficking

- Funding more body cameras for law enforcement to improve transparency

What’s next?

The Republican-led state legislature will craft and pass the final budget. Unlike the last budget cycle under Gov. Roy Cooper, Republicans no longer hold a supermajority. That means any budget will require bipartisan support or Stein’s approval to become law.

The North Carolina GOP has already criticized the governor’s proposal. Part of a statement from the group reads:

"Gov. Stein's proposed budget is more of the same failed Democrat policies the American people rejected in 2024. He wants to raise taxes and increase government spending while eliminating school choice options for students."