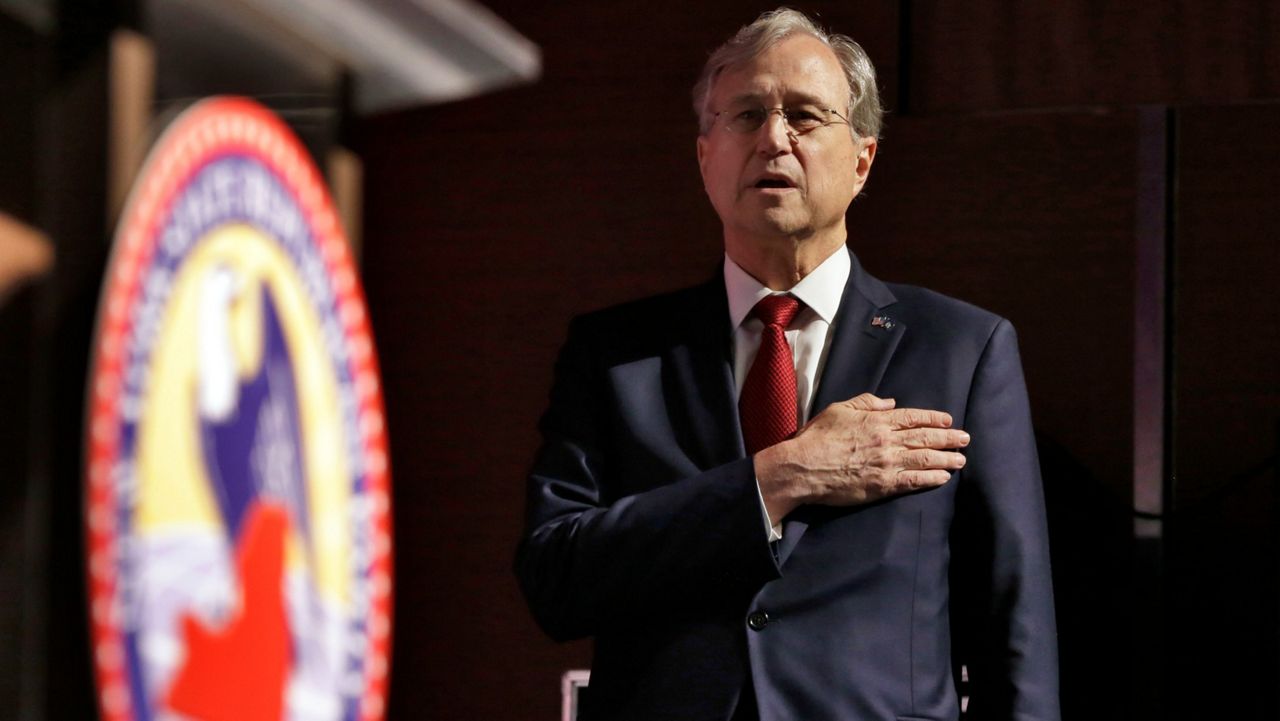

Albany County Executive Dan McCoy proposed an $847 million budget for 2025 that he said would increase spending by 3%, but reduce the county tax rate. But in proposing the plan on Monday, McCoy warned the cost of state-mandated programs was making it increasingly difficult to produce a budget without a tax increase.

McCoy said the 2025 proposed spending plan continues a trend of reducing the county's tax levy while maintaining and even widening some critical services. He said his budget plan would decrease the county tax rate to $2.73 per $1,000 in assessed property value from $2.84 this year – part of a 30% reduction since 2014 – while staying under the state-mandated tax cap.

The executive budget includes investments in workforce development, green energy and opioid addiction recovery programs, as well as some savings.

McCoy said the county has made government operations more efficient, pointing to $5.7 million in employee prescription drug costs it has saved in 2023-2024 through a partnership with Health Insurance Solutions, Inc., savings that he expects to continue.

McCoy stressed an estimated 20% increase in unfunded mandate costs from New York state over the last two years made it hard to balance this budget. Some of those include Medicaid, child welfare and other safety net programs.

"I am emphasizing this point so much this year because it was hard to stay flat and not raise taxes," he said.

The executive budget would commit another $250,000 to the Regional Food Bank and United Way of the Greater Capital Region to fight hunger, McCoy said.

Republican Frank Mauriello, the county Legislature's minority leader, commended McCoy for cutting the property tax rate and echoed his criticisms of unfunded mandates.

“I also believe we can and must use our excess reserves to deliver real and meaningful tax relief to hardworking residents in our County,” Mauriello said in a statement.

For a look at the full 2025 executive budget, visit the Albany County website here.

)