CHARLOTTE, N.C. — Many Americans are cutting back on spending.

Even though inflation is lower than in previous months, at 8.3%, prices for a lot of goods are still higher than ever.

According to an NPR/PBS NewsHour/Marist News Poll, 37% of Americans say personal finances have worsened in the past year.

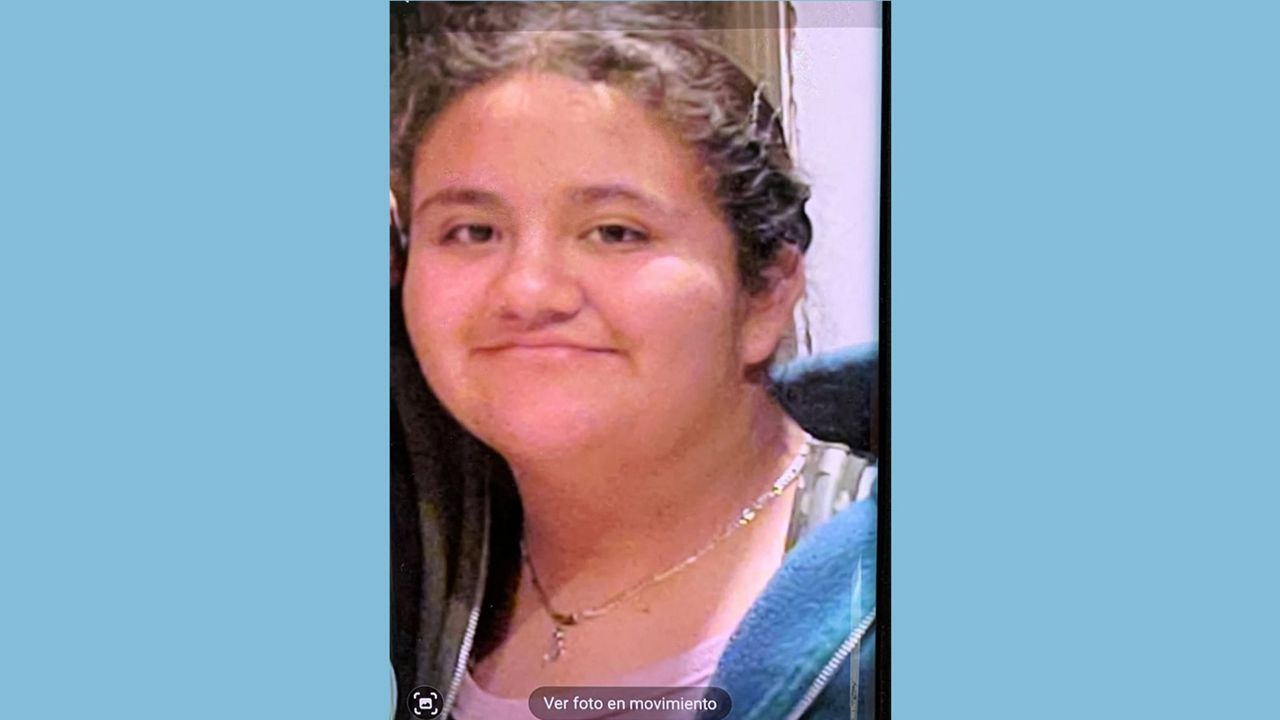

Charlotte resident Nathalie Santa Maria said this statement is true for her family.

“Medical expenses I didn’t anticipate I was going to have to pay for and the price of things have gone up while my income has stayed the same,” she said.

Santa Maria learned about budgetting at a young age.

“Our family has always been very frugal. My parents were sick most of my life and so making sure we had enough for our essentials was a practice we did,” Santa Maria said.

Taking a food inventory before going grocery shopping, creating a budget, making grocery lists, shopping around and buying in bulk and meal planning are practices she’s done in the past.

However, as she noticed her grocery bill increased 25% this year, these habits became even more important.

“With food is being really mindful of what’s on my list and make sure it matches the budget I set out to spend. If I said I’m not spending more than $150, something is coming out of the cart,” Santa Maria said.

Last year, she started using coupons as another way to save.

“I can save $2 to $3 on high-ticket items,” Santa Maria said.

For those starting to look for ways to save, she recommends list-making and not going to the grocery store hungry.

“Checking your fridge before you go to the grocery store. Is there something already in there that you need to cook or eat before you add something new? Checking the back of your pantry. Is there something that’s been long gone and forgotten and maybe we should bring it to the front and gets eaten before you add more things to your pantry or your fridge?” Santa Maria said.

Similar to 72% of the people polled, Santa Maria's family has cut back on at least one nicety or necessity in the last six months to make ends meet. This includes reducing the times they dine out and keeping vacations for leisure closer to home.

“For us is to make sure we have essentials to pay for things we need: our mortgage or food, our medical debt,” Santa Maria said.

She is hopeful inflation continues to drop.

“Having graduated with the recession, I know things will get better,” Santa Maria said.

Driving less, carpooling to save on gas, skipping vacation or doctor’s visits are other ways those polled said they are coping with inflation.

_Cropped)