Wilson Montoya’s last student loan payment was $600 dollars per month. But with interest, he said those payments still haven’t made a dent in what he owes.

“I started with a $70,000 loan, and now it's an $89,000 loan,” he said. “And I've been paying for six years, religiously, every month.”

As a social worker serving Long Island, NY, paying back loans became a balancing act between his student debt, mortgage and car payment.

“It was a struggle every month,” Montoya said. “Where am I going to get the money from, you know?”

Millions of borrowers like Montoya are waiting to see whether President Joe Biden will cancel a portion of their federal debt, after he promised on the campaign trail to “immediately forgive” $10,000 per borrower.

The prospect of that promise is now more urgent for some Americans, as a pandemic pause on student loan payments and interest is set to end on September 30, a freeze first approved by former President Trump in March 2020.

Advocates and lawmakers are now calling on the Biden administration to both extend that pause and also offer longer term relief through federal debt cancelation.

“Borrowers are being stymied both in their personal and economic lives,” said Seth Frotman, executive director at the Student Borrower Protection Center. “If we were to unshackle them from the weight of student loan debt, you would see this enormous ripple effect across the American economy.”

Cancellation would impact the 45 million Americans with loans, who owe a total of $1.6 trillion. A $10,000 cancelation for each of them would cost around $380 billion.

For now, the White House has punted the issue to the departments of education and justice, which are reviewing President Biden’s authority to forgive loans by executive order, partly because that move could be met with legal challenges.

“This is authority that exists under the law,” said Frotman, who tracked federal student aid for the Consumer Financial Protection Bureau. “Borrowers are entitled to many of the forgiveness programs that we're talking about.”

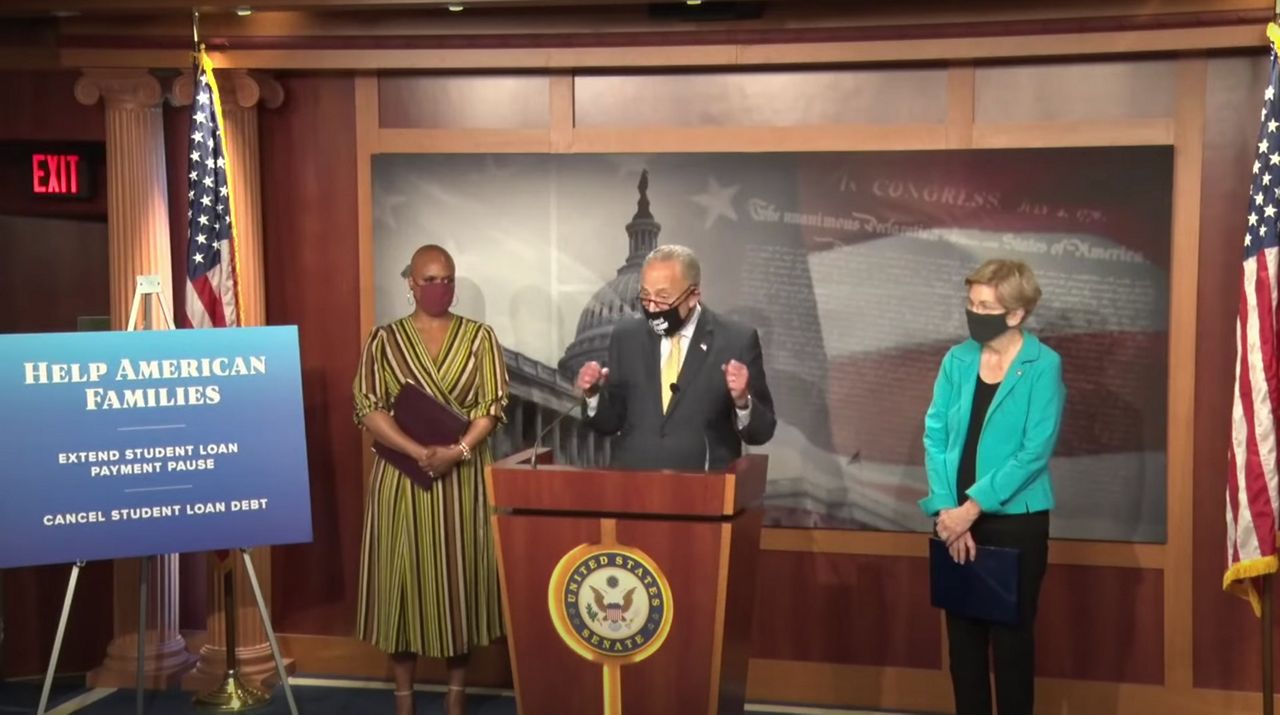

A group of Democrats on Capitol Hill, including Majority Leader Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass., have called for the president to do it with the “flick of his pen.”

The group, which introduced legislation to forgive $50,000 in student debt per person, includes freshman Rep. Mondaire Jones, who represents upstate New York.

Jones acknowledged that it’s unlikely a bill to forgive loans would get through the evenly-divided senate.

“The idea that we would get some bipartisan support to overcome the filibuster, for example, for the purpose of liberating an entire generation of young people by canceling student debt? [It’s] just unrealistic,” he said.

House Speaker Nancy Pelosi, D-Calif., refuted that notion on Wednesday, saying forgiveness must be done by Congress.

“[The president] does not have that power,” she said in a press conference.

The price tag to forgive $50,000 would be closer to $1 trillion.

When President Biden last spoke on the topic in February, he wasn’t convinced that $50,000 of forgiveness was viable.

“I’m prepared to write off the $10,000 debt but not 50, because I don’t think I have the authority to do it,” he said in a CNN town hall.

That’s why federal agencies are taking a closer look at what he can do, and a spokesperson for the Education Department told Spectrum News that the review “remains ongoing.”

Critics of loan forgiveness say it would lead to a loss in federal revenue that could hurt down the line, either in the form of higher taxes or less spending on other important government aid.

“Blanket loan forgiveness is not the answer,” said Republican Sen. John Thune, R-S.D., on the senate floor after Democrats first introduced their proposal. “I hope President Biden will resist Democrat calls to put taxpayers on the hook for billions of dollars in student loans.”

“If the government takes in less revenue, the government has to either raise other revenue or cut spending. That means either taxes are going to go up, or other programs are going to be cut,” said Constantine Yannelis, an economist at the University of Chicago who recently published an analysis of which earners student debt cancellation would benefit.

“There are other policies which target debt forgiveness to lower income individuals,” he said, pointing to an expansion of income-driven repayment plans as one solution.

Proponents, meanwhile, say forgiveness will boost the economy.

“We want people to be buying homes, for example, which is the single biggest generator of wealth in this country historically,” Rep. Jones told Spectrum News.

As of late July, repayments and interest were still paused through September 30, due to the pandemic.

Recent polls show a majority of borrowers are not ready to start making payments again. A Pew Trusts survey of about 1,500 borrowers found that two-thirds said it would be difficult to resume paying their loans.

And another from the advocacy organization Student Debt Crisis found 86% of borrowers surveyed said the pandemic freeze on payments made them more likely to support permanent cancellation.

Advocates and lawmakers are calling for an extension as the clock ticks toward the fall.

“We’re two months away,” Sen. Warren told reporters Tuesday. “That’s a real on-the-ground impact.”

“It’s gonna be a struggle every month, beginning September, trying to come up with the money for that,” Montoya said.

An education department spokesperson wouldn’t comment on a possible extension but told Spectrum News they are “continuing to closely review data related to return to repayment” and remain committed to helping borrowers.