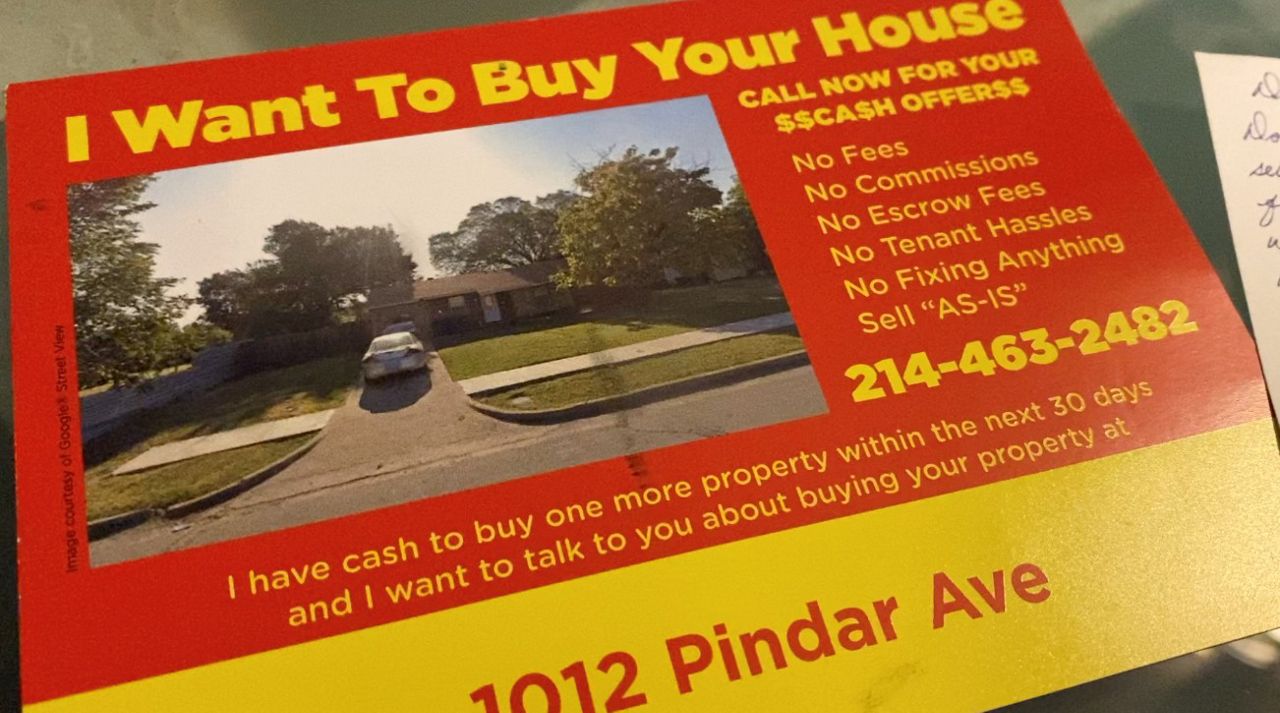

DALLAS — The City of Dallas may be in talks to implement some restrictions on real estate investors in the DFW area after many residents have complained of an alleged "exploitation" of home sales.

Recently, Dallas received accolades for its fast-growing real estate market, joining the likes of Los Angeles, Chicago and New York City. But is it really such a good thing?

“Median home prices in North Texas jumped 22% year over year in March.”According to a Fox 4 report, “Median home prices in North Texas jumped 22% year over year in March.”

Home buyers are finding it harder to afford the rise in prices, some even being priced out of the market by investors, and high mortgage rates don't help. Sure, it generates more revenue in the city, but if the cost of living is skyrocketing, who will be left to afford the stay?

That’s why the City of Dallas is considering putting a cap on how many properties real estate investors can buy, according to reports from multiple news outlets.

In a Reddit thread, many users relayed similar sentiments concerning egregious home prices, and middle-class workers seem to be the main ones affected by the perceived greed. Some even recount investors purchasing homes in Arlington and turning them into Airbnb rentals.

In a recent Dallas City Council meeting, Councilwoman Jaynie Schultz asked, “Are we working on a bigger policy regarding the scourge of investment buyers? It is across the country, where individuals are no longer buying homes, but REITs are.”

Dallas Director of Housing David Noguera cited a Canadian policy that aided in resolving similar real estate problems. “Canada restricts how many foreign investors can come into your market and buy up your real estate,” he said.

Reddit users also commented on the two-year home sales ban Canada applied to foreign investors, with one saying, “They should completely cut off foreign investors. In this case, foreign means anybody that isn’t registered in Texas. Global investors as well as Wall Street investors wouldn’t be able to plunge local economies.”

Another voiced their skepticism, writing, “...I’m skeptical that laws such as this one would actually work as intended and not just restrict small time landlords from buying investment properties, while only acting as a speedbump to the megacorps that are actually causing the runaway housing prices.”

With that, Dallas will look into potentially creating its own policy, and maybe taking this matter to state legislation.