Monroe County has reached its highest credit rating since 2001.

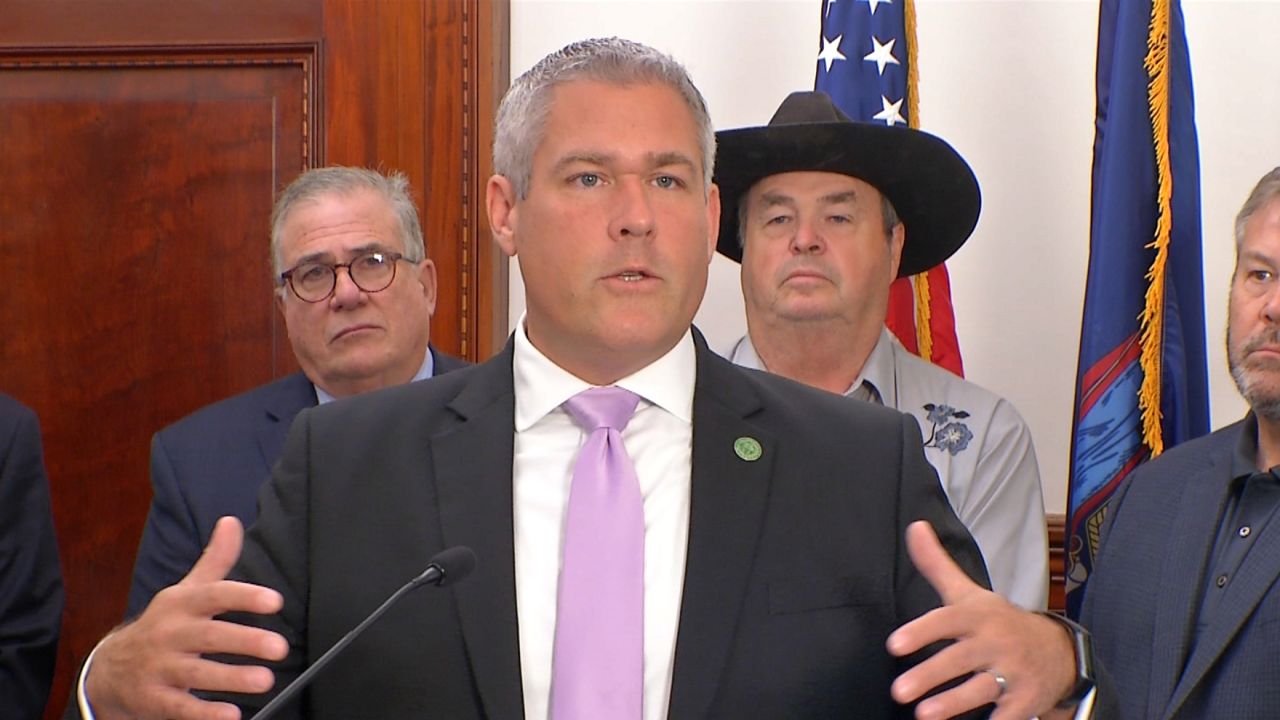

County Executive Adam Bello announced on Wednesday that Standard and Poor's Global Ratings had lifted Monroe County's grade to AA with a stable outlook.

This is the second increase that S&P has given the county under Bello and means county projects could cost less moving forward.

According to S&P, the higher rating is due to significant growth in the county’s reserves and the agency expects that county officials will continue to “adhere to conservative financial policies, leading to balanced operations over the near term while also experiencing ongoing economic expansion.”

In conjunction with the news, Bello announced his tax levy plans for the next budget.

"There will be no property tax increase for 2024. Zero," said Bello. "And, in fact, because the overall value of property in the county is increasing as we continue to grow here and attract new businesses and have new development, for a lot of our residents this is gonna translate to a tax cut."

Overall, this is the fourth time in two years that one of the big three credit rating agencies has elevated Monroe County’s credit rating. S&P increased the credit rating from A+ to AA- in June 2021, Fitch Ratings Inc. bumped the bond rating to A+ in February 2022 and in October 2022, and Moody’s Investor Service raised the county’s bond rating from A2 Stable to A1 Positive.