A team of local developers wants to build a 104-unit apartment complex on Route 9W in Marlboro, something town leaders have said is sorely needed, but the developers said that in order to proceed with the project, the Ulster County Industrial Development Agency must approve their request for a property tax break worth more than $5 million over 18 years.

Neighbor and contractor Aisha Kuka said a large tax break for the "Marlboro Bayside" project would be unfair to companies like her family’s construction business.

She said the business has never been allowed to withhold taxes in order to make a project feasible, and as tight as some project budgets were, they made it work.

What You Need To Know

- A developer’s request for $5 million in property tax relief is drawing mixed reactions

- Developer Eric Baxter said the project site’s terrain makes it difficult and costly, and several builders have tried to fund housing projects here before, only to cancel plans

- Baxter said his team is trying to lower their tax burden to make the project more attractive to lenders

“That’s a lot of money,” Kuka said of the tax break request. “The middle class are the ones who suffer, because the rich, they don’t care. They have so much money.”

Developer Eric Baxter said Sept. 1 during a Zoom interview the project site’s terrain makes it difficult and costly, and several builders have tried to fund housing projects there before, only to cancel plans.

Baxter said his team is trying to lower their tax burden to make the project more attractive to lenders.

“It allows a higher valuation to the property,” he said, “so you can get more bank financing.”

Rent for a two-bedroom at the Bayside would start at about $1,800, while three-bedroom apartments would fetch $2,200, according to the developers’ tax relief application to the IDA.

The IDA awards payments in lieu of taxes (PILOTs) to projects that create jobs and provide a public benefit. Multiple nearby property owners other than Kuka, who took issue with the tax break request because of fairness, are not alone.

“This is a terrible project to give a PILOT to,” District 39 State Senator James Skoufis said of the request.

In their PILOT application, the developers estimated the project would create three full-time jobs. They said approximately 200 potential new customers living within a short walk of downtown businesses and a new bus entrance for nearby Marlboro Middle School would represent public benefits from the Bayside project.

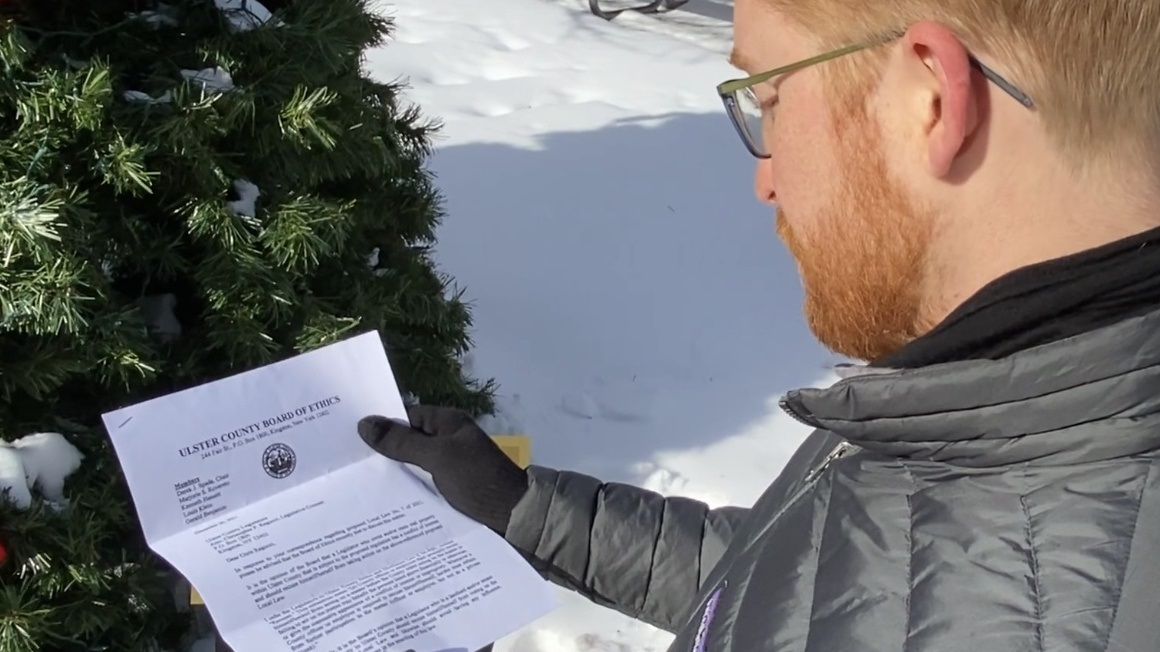

Skoufis, a critic of several IDAs in his district and statewide, is not impressed with the developers’ offerings. He wrote to the Ulster County IDA board to ask its members to reject the PILOT request.

“The folks who are struggling to start their small businesses, they are the ones who need help,” Skoufis said. “The ones who have tons of money already and can go to a bank and get millions of dollars, and have lobbyists and lawyers to cut all these deals for them, they’re the ones who need a lot less help.”

Marlboro Town Supervisor Al Lanzetta said he finds the project to be “just right” for Marlboro, and he likes the developers’ previous projects in Dutchess County. He does not, however, believe the developers should receive the tax break, as taxpayers have had to make up for revenue lost from two major companies who have left the town.

“I’ve gotten several calls about this whole PILOT,” he said. “It’s in the right area. It’s on the 9W corridor. It goes along with our comprehensive plan. But overall, it can’t shy away from the taxes.”

Since the developers are asking to withhold taxes from both the municipal levy and school district levy, the developers must present their project and PILOT request to both the Town Board and school board. Both boards will make recommendations for, or against, the PILOT request, but the Ulster County IDA will make the final decision, regardless of how the boards vote.

Ulster County IDA CEO Rose Woodworth said both boards’ recommendations will be considered, but the IDA board is not obligated to follow them.

“Legally, it doesn’t mean the project would stop,” Woodworth said of the next steps if a taxing authority’s board were to vote against the PILOT. “I’m not sure if the board would feel it necessary to go around the taxing jurisdictions or not. They would have to have a strong desire to override a recommendation."

The last time a taxing jurisdiction in Ulster County voted against a PILOT for a project that included housing was less than a year ago: The Kingston School Board rejected a PILOT request for more than $25 million for developers of the mixed-use Kingstonian project.

The Ulster County IDA board went against the school board’s recommendation and approved the tax relief for developers Brad Jordan and Joe Bonura Jr.

The Kingstonian project has since been tied up in litigation.