Erice Treece's two sons, one in high school and the other in middle school, are heading back to the classroom in the city of Albany.

"I prefer to have them in school," Treece said. "My kids benefit from teachers that are there physically and engaging with these teachers. So we're taking it quarter by quarter."

Students and teachers are returning to the classroom either physically or digitally. But how school districts fare in the coming weeks could be up to what happens in Albany.

Treece is worried about the effect of spending cuts on his kids' school district and that some students may fall behind.

"A lot of these kids, they come into school for more than just the books, the academics," he said. "They come into school because they have relationships with teachers that go the extra mile."

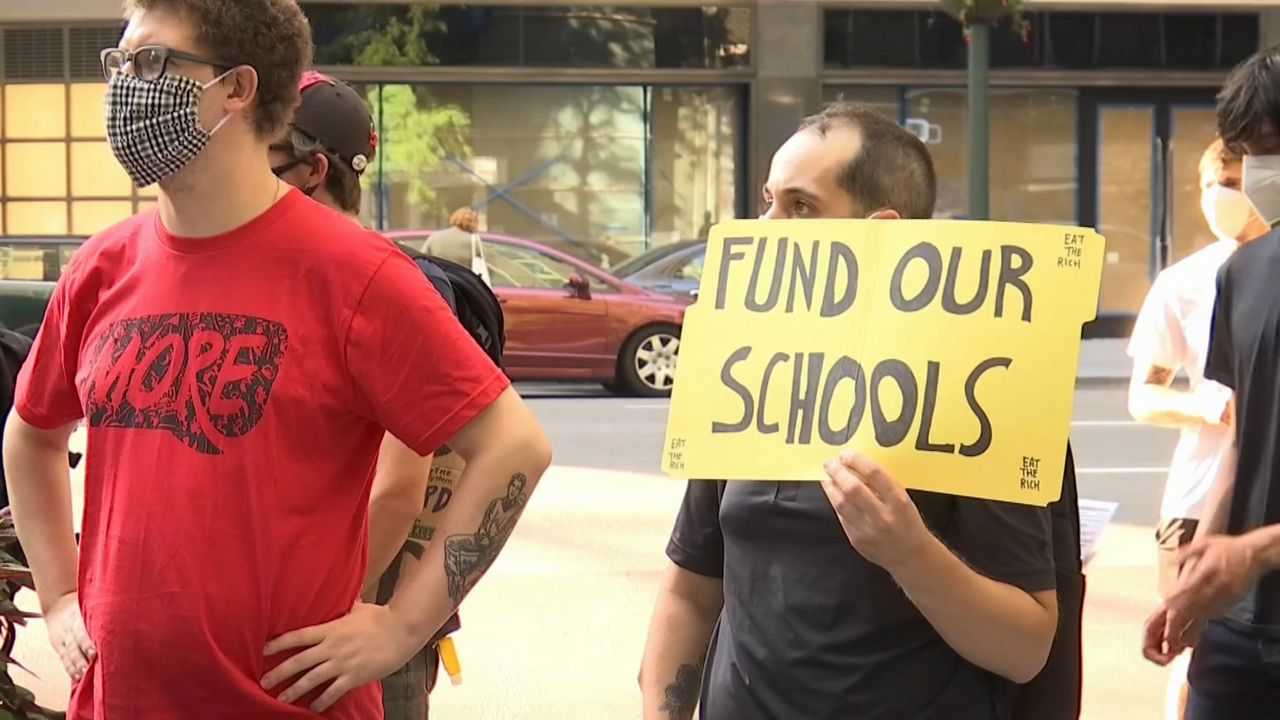

State lawmakers, parents, and school district leaders on Wednesday called for action on bolstering school budgets that have been slammed by the economic devastation caused by the coronavirus pandemic. And if federal aid doesn't come through, there's talk of hiking taxes on the rich to make up the difference.

Assemblywoman Pat Fahy says a special session of the Legislature has not been ruled out.

"I think the pressure is building on mulitple issues, but the most immediate right now are the schools, let alone a whole host of non-profits who have not gotten any reimbursement and are still with this 20 percent cut," said Fahy.

Ideas are abound among Democrats in the state Legislature. Some want a stock transfer tax enacted, while others are calling for a tax on pied-a-terre homes. But broadly, the tax hikes would likely be on the richest New Yorkers, those who make $5 million and above.

Governor Andrew Cuomo for now has not embraced the tax hike proposal on the state. He supports doing so on the federal level, which is unlikely, given the current configuration of Congress and the presidency. Cuomo worries that taxing the rich would send high earners out of state.

New York relies heavily on a handful of wealthy tax filers for its personal income tax revenue.

Instead, Cuomo is holding out hope for federal aid. Opposition to the tax hike in New York also stems in part from Cuomo not wanting to lose the bargaining chip over federal aid.

But the effects of the dried up revenue are already being seen.

For school districts like Albany, the withholding of 20 percent in state aid is leading to more than 200 jobs being cut. Parents like Eric Treece are worried not just what the next few weeks will bring, but the long-term effects of the cuts.

"There's enough money to go around," Treece said. "Maybe they can cut something else. But education should be a priority. I want my kids to have a quality education."

At the moment, there are no indications if lawmakers will return for a special session of the Legislature.