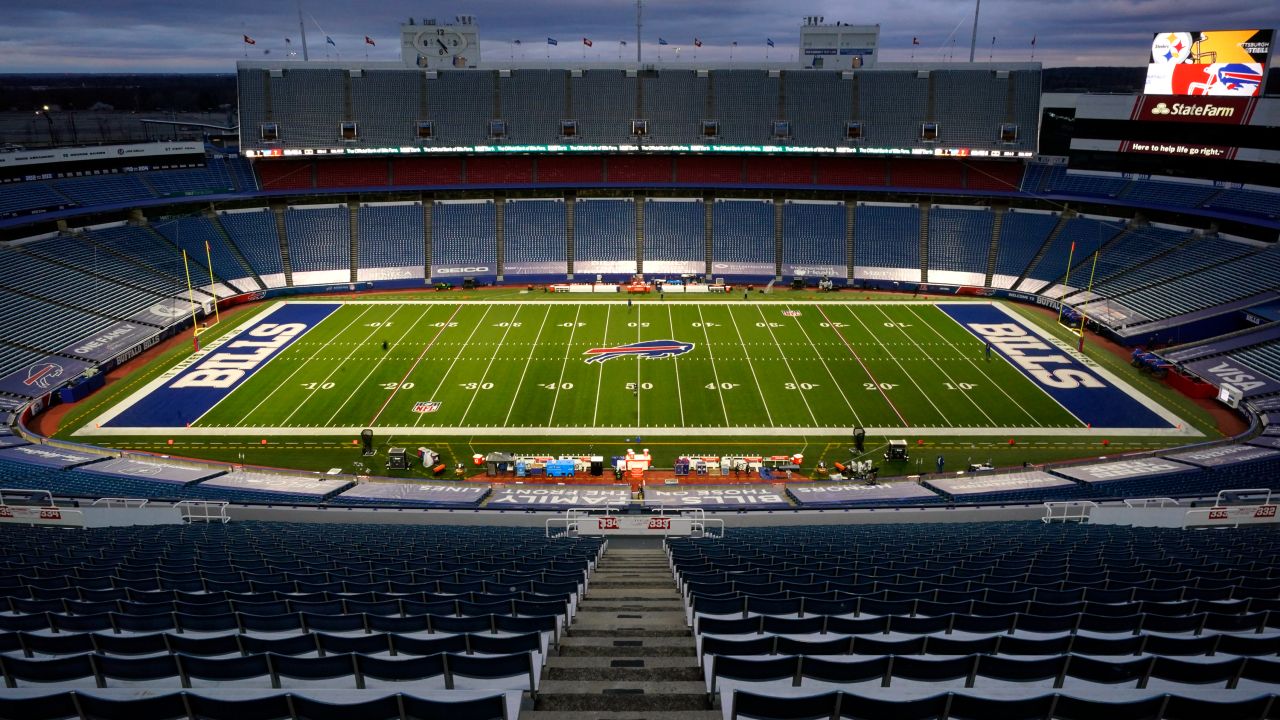

ORCHARD PARK, N.Y. (AP) — The Buffalo Bills’ bid to land a new, taxpayer-backed stadium has been narrowed to two sites, with renovating their existing facility essentially being ruled out as being cost-prohibitive.

A feasibility study financed by the state of New York that was released Tuesday backs the Bills’ proposal to build a new 60,000-seat stadium either near their existing home or downtown.

The study estimates that a new stadium at the team’s proposed location, across the street from its current home in Orchard Park, would cost $1.354 billion. Building one downtown would, at a minimum, add $750 million because of the need to acquire land and make necessary infrastructure upgrades.

Multinational engineering and consulting firm AECOM recommended against renovating the 48-year-old Highmark Stadium, projecting it would cost about $862 million. AECOM cites “a tipping point” when the cost of renovations exceed 60% of building a new facility.

AECOM based its findings on the proposal the Bills submitted to the state government this summer. The findings align with the team's projections, which estimated a new stadium in Orchard Park would cost about $1.4 million.

AECOM's study did not recommend either preferred site. That decision will be left to the state, Erie County and the Bills in negotiations, which are expected to resume shortly.

The key issue is how much money the state and county will be required to commit, with the Bills anticipating taxpayers will be asked to bear more than 50% of the cost.

“We are confident that the results of this analysis will be a valuable tool as the state, Erie County and the Buffalo Bills work together to make sure the team remains in the region in a facility that Bills fans and New Yorkers can be proud of for years to come,” said Kevin Younis, CEO of Empire State Development, which commissioned the study.

Though the Bills’ lease on their current stadium doesn’t expire for 21 more months, time is running short on reaching a financing agreement.

“If we get to January and there’s no new deal done, you should really be concerned,” Pegula Sports and Entertainment executive vice president Ron Raccuia told The Associated Press last weekend. PSE is the Bills’ parent company, with Raccuia overseeing stadium negotiations.

Raccuia already has said PSE has no intention of renewing the lease once it expires in July 2023 if no deal is in place. The threat of relocation is a possibility — even though it has not been raised in talks, and Raccuia maintains the Bills are solely focused on reaching an agreement with state and county officials to help finance the new stadium.

Having a deal in place by January would allow Gov. Kathy Hochul to include stadium funding in her budget proposal for approval in April. With Hochul up for election next fall, it’s unlikely she will have time for negotiations while campaigning.

The Bills, meanwhile, are concerned they might have go back to square one in negotiations should there be another change in governor.

Hochul, who is from Buffalo, is well aware of the time constraints, saying last week it is her intention to have a deal in place in time for the budget.

The study finds the Bills bring in about $26.6 million in annual tax revenue. Though more expensive, a downtown site would be projected to generate about $53 million in additional tax revenue over a 30-year span.

AECOM could not project how much of those revenues would be lost if the Bills relocated out of state.

“There are significant intangible benefits associated with serving as the home of an NFL franchise that can impact policy decision related to investment in a stadium and surrounding neighborhoods,” the study said.

The Bills’ proposal does not include a roof, but features a curved design which would protect about 80% of the seats from the elements. Highmark Stadium is mostly open air, with few seats protected from the weather, which the Bills say lead to lower attendance for late-season games.

AECOM projected adding a roof would add close to $300 million in additional costs. If the decision was made to include a design that could one day incorporate a roof, it would cost $109 million more — not including the cost of the eventual roof.