MADISON, Wis. — Nearly every scammer has the same goal: Separate you from your money.

Tax season, which runs from Jan. 1 to April 15 each year, is just one opportunity scammers have to prey on potential victims.

Robin Kaczmarski, a retired Wisconsin woman, spends most of her free time at her Dane County home crocheting.

Like many other Americans, Kaczmarski often uses TurboTax to file her taxes every year.

In early Feb. 2025, she started the tax filing process; that night she got a text from what she thought was TurboTax.

“At about 9 that night, I got that text message saying, ‘Here is your number from TurboTax and don’t share this with anyone,’ and I thought, ‘Well, that is odd because I did not finish doing them,’” Kaczmarski said.

Kaczmarski made the mistake of interacting with the message.

She said after that, everything spiraled out of control.

“I couldn’t make a call; I couldn’t receive a call. I couldn’t send a text message or get one; they were all saying, ‘pending,’” Kaczmarski said.

After contacting her cellphone company, she discovered her number had been transferred to an entirely different phone.

“I said, ‘How can they do that?’ because my phone has not left the house and the phone company said, ‘They don’t need the phone to take your number,’” Kaczmarski said.

This is when Kaczmarski found out she was a victim of SIM swap fraud.

Dave Schroeder, a cyber security expert at the University of Wisconsin-Madison, said SIM swap fraud is when scammers transfer your phone number to another device without your authorization.

He said he sees scams like this all the time.

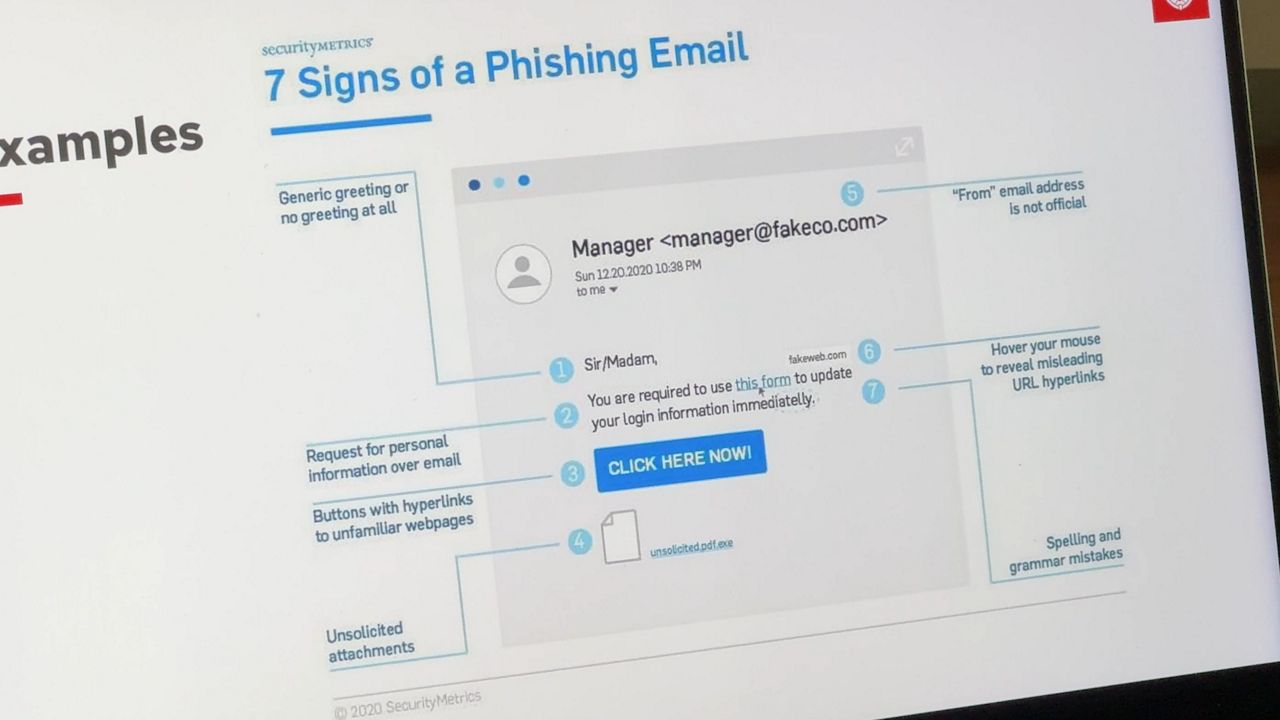

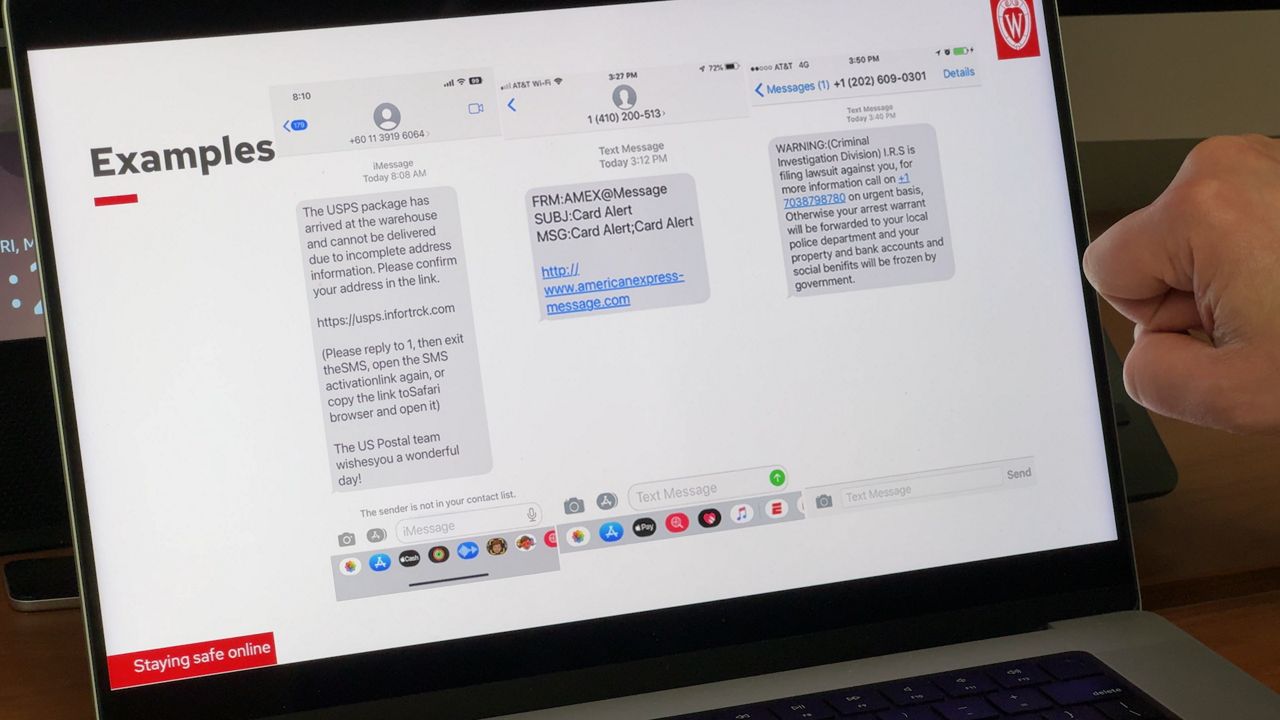

“Every one of these things will have a message saying you need to update your account, you need to click here; those are all going to be not Microsoft, not PayPal,” Schroeder said.

Schroeder said every scammer has the same goal: To separate you from your money.

“They are going to call you, text you, email you and all of these things have something in common and that is trying to get you to take action urgently,” Schroeder said.

AARP reported that identity fraud and scams cost Americans $47 billion in 2024.

Kaczmarski said after scammers got her phone number, they tried to steal her money, too.

“I called the credit union, and they said someone had tried hacking in using my name and trying different passwords,” Kaczmarski said.

Kaczmarski was fortunate and said she did not lose any money, but said she lost the ability to feel safe in her own home.

”I would sit in bed at night thinking, ‘Well, what am I not thinking of? What have I forgotten to secure?’” Kaczmarski said.

Schroeder said there are things that people can do to make sure they do not get hacked or scammed such as keeping software up to date on devices, never reusing passwords and writing passwords down instead of saving them on a computer or phone.

He said the best way to avoid being scammed is to slow down and look for things such as spelling errors or unknown phone numbers.

“Even if you think, ‘Maybe this is my bank,’ or, ‘Maybe this is my financial institution calling,’ you can always hang up and call back using a number that you know to be correct,” Schroeder said.