Many hospitals in North Carolina justify high health care prices by saying they lose money treating Medicare patients, according to a report from State Treasurer Dale Folwell. But most of those same hospitals actually make a profit off treating older patients on Medicare, a new report finds.

People in North Carolina on private insurance or the State Health Plan pay 280% more than Medicare patients, according to the report. Because of the high costs, the State Health Plan could be insolvent by 2025, the report said.

“The hospital cartel is overcharging you because they can, not because they need to,” Folwell said. “Hospital executives can’t keep hiding behind Medicare. They tried to claim huge losses to justify financially kneecapping their patients. But now we know that the majority of hospitals are actually profiting off Medicare.”

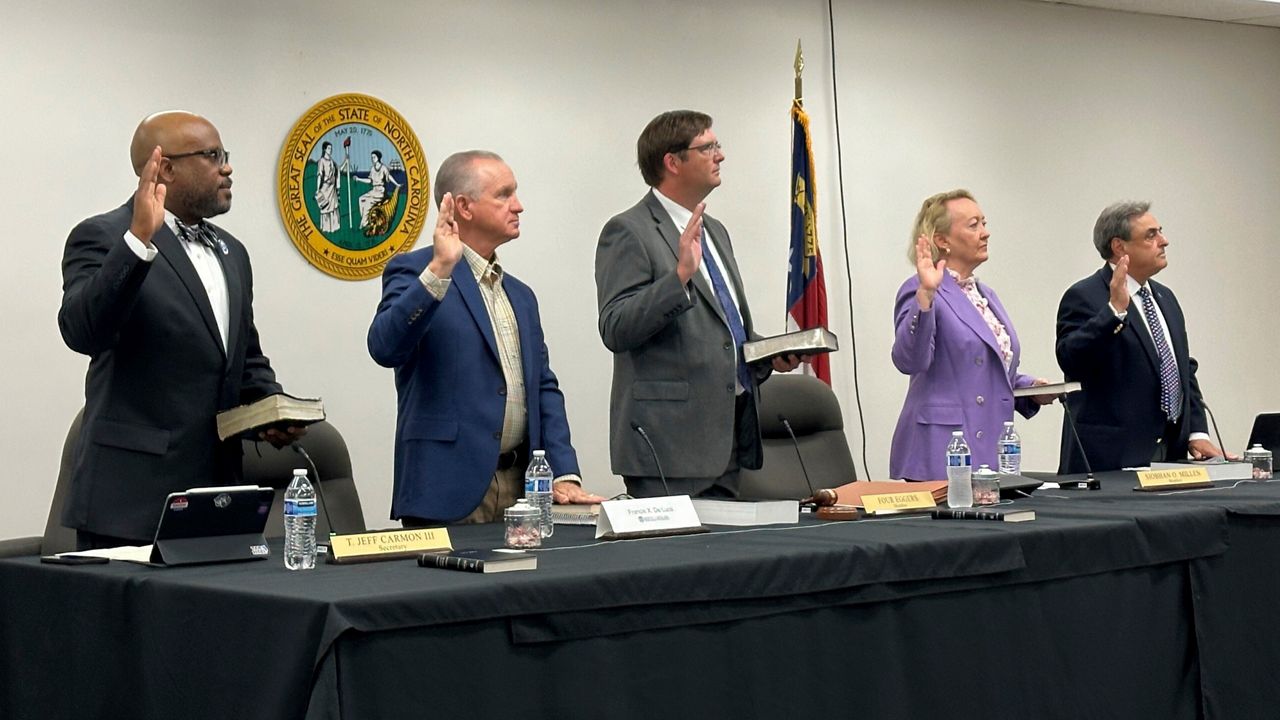

Folwell, a Republican, commissioned the report from researchers with the North Carolina State Health Plan and Rice University’s Baker Institute for Public Policy.

The first line of the report is blunt: “Too many North Carolina hospitals are overcharging patients and taxpayers.”

Hospitals, and their lobbyists, justify these high prices by saying they lose money treating Medicare patients, the report states. Medicare is the federal program to insure people 65 and older. The problem, the researchers found, is that a majority of hospitals in North Carolina actually profited from Medicare.

The researchers used the nonprofit hospitals’ tax filings and their community benefit reports, where they report things like charity care and treatment for people on Medicare and Medicaid.

“Despite hospitals’ claims of losing billions of dollars on Medicare patients, their data shows a vastly different picture,” the report states.

According to the report, Atrium Health claimed it lost $640 million treating Medicare patients in 2019. But the hospital company actually made almost $120 million that year treating patients on one of the Medicare programs.

“Alleghany Memorial Hospital cited Medicare losses of $968,868 on its 990 tax filing in 2019, while reporting a profit of $90,960 on its Medicare Cost Report,” the report states.

Hospitals in North Carolina make more money off Medicare than those in almost any other state, the report said. In 2020, North Carolina’s hospitals had an average profit margin of almost 2%, making it “the sixth-highest Medicare profit margin in the nation,” according to the report.

“These findings confirm what many economists have suspected for a long time,” said Vivian Ho, an economist at Rice University who worked on the report. “The hospital prices paid by privately insured patients aren’t just covering the costs of caring for Medicare patients. These prices are much higher — high enough to generate a generous profit margin for many hospitals.”

The North Carolina Healthcare Association, which represents the state’s hospitals, disputed the report.

“The reality of the current situation in North Carolina is that a majority of hospitals have negative operating margins this year and that both Medicaid and Medicare reimburse hospitals for caring for patients below the actual costs of providing that care,” the association said in a statement.

“The latest report commissioned by Treasurer Folwell continues a pattern of reports that have used misinformation and half-truths and that make inaccurate conclusions,” NCHA said. The association said the report does not account for other complex parts of the health care system and the role of insurance companies in driving up costs.

“He fails to explain that the biggest culprit is health insurance companies. Blue Cross Blue Shield of North Carolina controls 97% of the individual private health insurance market and is the administrator of the state health plan, which Mr. Folwell oversees,” the association said.

The state treasurer has been warning that rising costs could push the North Carolina State Health Plan over the edge. The plan insures more than 700,000 people in North Carolina, including teachers, state employees, retirees and their families, according to state data.

“State employees must work one week out of every month just to pay their family premium,” according to the state treasurer. “The State Health Plan is facing fiscal insolvency in less than three years unless costs are cut.”

If health care costs continue to rise, figuring out how to pay for it could fall to state employees.

“While hospitals claim they are poor and take in secret profits off taxpayer money, the solvency of the State Health Plan is being put in danger,” said Ardis Watkins, who heads the State Employees Association of North Carolina. “Without the price transparency Treasurer Folwell is seeking and hospitals are fighting against, we are likely to see plan costs shifted to the backs of public employees in the next few years."

Folwell has long called for health care reform and taken hospitals to task for high prices.

“This is the Wild West,” he said as he released this latest report. “Nobody’s watching it. Nobody’s holding them accountable. We need a commitment from the cartel to get back to their original mission and to stop putting profits over patients.”

In June, Folwell said North Carolina’s seven largest hospital systems of reaping a massive windfall during the worst of the COVID-19 pandemic.

“Taxpayer-funded COVID relief gave a huge wealth transfer to wealthy hospital systems. Even as they complained of financial losses, wealthy hospital systems enjoyed record profits and a massive $7.1 billion growth in cash and investments during the pandemic,” the Treasurer’s Office said.

“These systems boasted huge reserves, but they still took the bulk of the relief funds meant for struggling hospitals — and then failed to dedicate more than a fraction of their windfall to increasing charity care for their suffering patients,” according to the Treasurer’s Office.