Real property assessment notices for the 2025-26 tax year will be going out this week to property owners across Oahu and should be done by Dec. 15, according to the City and County of Honolulu’s Real Property Assessment Division.

Notices will be sent to roughly 307,000 property owners via the United States Postal Service or by email for those who have subscribed to electronic delivery.

According to the Real Property Assessment Division, the total assessed value of all real property on Oahu is increasing from $346.36 billion to $354.82 billion, which reflects an approximate 2.44% increase.

Key classification changes include:

- Residential: +1.73%, from $232.55 billion to $236.56 billion

- Residential A: +6.91%, from $45.43 billion to $48.57 billion

- Hotel and Resort: +2.89%, from $18.03 billion to $18.55 billion

- Commercial: +0.91%, from $29.34 billion to $29.60 billion

- Industrial: +3.42%, from $15.64 billion to $16.17 billion

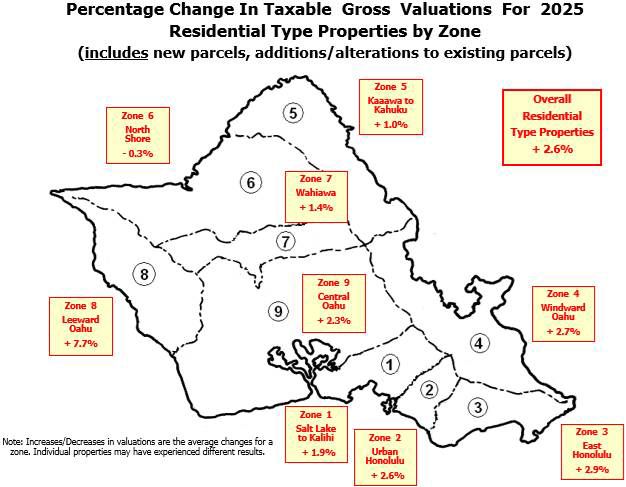

Increases represent islandwide totals and may not reflect changes specific to individual properties or neighborhoods.

The Real Property Assessment Division reminds the public that the notice of assessment is not a tax bill.

The assessed values reflect the full fee simple value of properties as of Oct. 1, 2024, based on sales of similar properties through June 30, 2024. The division says that “while the real property assessment is used to determine the amount of taxes, the City Council will set the tax rate for each classification in June 2025.”

Property owners will receive the first-half tax bill in July 2025.

Those who do not agree with their assessment can file an appeal between Dec. 15, 2024, and Jan. 15, 2025, by following these instructions:

- Appeals must be submitted in person by 4:30 p.m. HST on Jan. 15, 2025

- Appeals mailed must be postmarked on or before Jan. 15, 2025

- Appeals filed online will be accessible from Dec. 15, 2024, on the Real Property Assessment Division’s website and must be submitted by 11:59 p.m. HST on Jan. 15, 2025

- A $50 deposit is required for each appeal

- Make checks payable to the City and County of Honolulu and enclose a self-addressed stamped envelope with your appeal application to receive a receipted copy of the appeal

For faster processing, include supporting evidence together with the appeal form.

Property owners who have questions or those who wish to file an appeal can call the Appeal Hotline at 808-768-7000 from 7:45 a.m. to 4:30 p.m. HST between Dec. 16, 2024, and Jan. 15, 2025. Inquiries can also be emailed to bfsrpmailbox@honolulu.gov.

Visit the Real Property Assessment Division’s website to access real property records, pay property taxes electronically, file home exemption claims and submit appeals.

Property owners who have not received their 2025 Notice of Assessment by Dec. 31 are advised to contact the Real Property Assessment Division at 808-768-7000.

The Real Property Assessment Division has two locations: 842 Bethel Street, Basement in Honolulu and 1000 Uluohia St., #206 in Kapolei.