HONOLULU — Amid slowing U.S. and global economies, a weakened yen and Maui’s faster-than-expected but yet highly uncertain recovery, Hawaii’s economy is expected to grow at a slower pace in 2024, according to University of Hawaii Economic Research Organization.

The projections are contained in the UHERO’s fourth-quarter forecast for 2023, which was released on Friday.

According to UHERO, a deceleration in key visitor markets will result in slow growth in the coming years, but moderate gain should resume in 2025 as long as the U.S. does not fall into a recession in the meantime.

“While Maui’s recovery remains top of mind, the state as a whole has continued to grow at a moderate pace, and only gradual slowing is expected,” the forecast states. “But, as always, Hawaii is somewhat at the mercy of conditions beyond our shores. A sharper slowdown or recession in the U.S. mainland would mean a sharper slowdown in Hawaii in 2024–25.”

As the report explains, the U.S. has performed better than most advanced economies over the last year, although high interest rates have weighed on investment and the labor market has softened. Inflation is expected to slow as consumer savings dwindle and consumer spending declines. This is expected to bring inflation into the Fed’s target range, achieving the hoped-for “soft landing” of 1.1% growth next year.

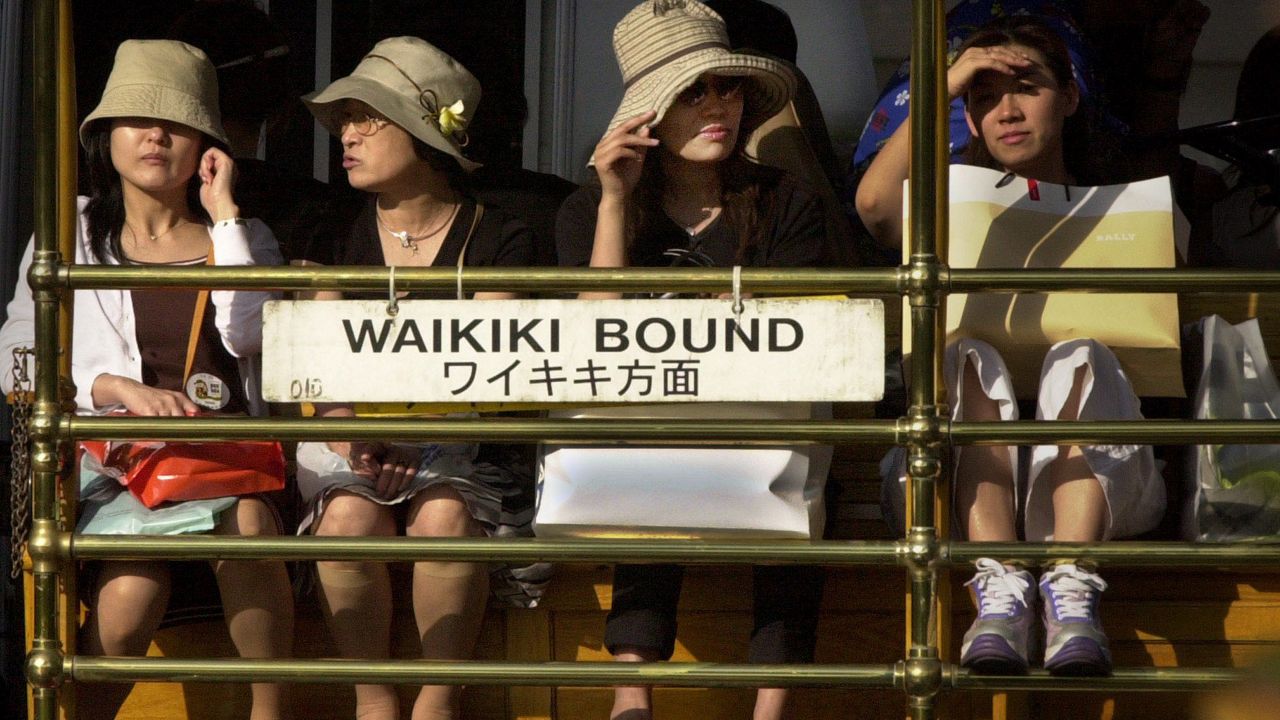

Japan’s efforts to combat inflation are expected to ease pressure on the yen but, to date, a weak yen has slowed the return of Japanese tourism to Hawaii and constrained visitor spending on Oahu, dipping below pre-COVID levels. According to UHERO, the yet-diminished number of Japanese arrivals has left the state unusually reliant on domestic tourism. The UHERO report predicts that the total number of visitors to Hawaii will be essentially flat in 2024 before improving in 2025.

The August wildfires on Maui continue to leave an imprint on the state’s economic condition.

UHERO notes that Maui’s visitor industry has been recovering faster than anticipated and the number of visitors to the rest of the state has reached record levels. Still, the disruption of high-priced Maui tourism has negatively impacted overall visitor spending, despite increases in spending on Kauai and Hawaii Island.

Overall, UHERO forecasts a drop in real visitor spending in 2024.

Statewide payroll employment was rising at a modest rate in 2023 before stalling in the aftermath of the wildfires. On Maui, displaced workers found alternative work in recovery or other lines of employment, resulting in faster partial employment recovery than initially expected. (UHERO also noted that some workers left the island after the fires.) Hawaii job growth is expected to be about 1% next year, according to UHERO.

“There remain a host of uncertainties surrounding Maui’s future recovery path, including how fast residents can be moved from hotels to more permanent housing, the speed of ongoing cleanup work, the extent and duration of support programs, and how long and in what fashion rebuilding will occur,” according to UHERO.

While inflation remains a concern, conditions are likely to gradually improve, UHERO predicted, noting that consumer price inflation has receded from its peak of 7.5% in March 2022.

According to the forecast, high housing costs will keep inflation between 3% to 3.5% for the next year before a slow downward trend resumes. Incomes are above pre-pandemic levels and are expected to grow about 2% per year heading forward.

The report also includes an ominous forecast for the home resale market, which continues to suffer from high mortgage rates, high prices and a lack of inventory by homeowners reluctant to give up low interest rates. Rebuilding efforts on Maui are expected to drive an already “hot” construction industry.

As UHERO noted, “Getting – and housing – the needed workers will be a challenge.”

Michael Tsai covers local and state politics for Spectrum News Hawaii. He can be reached at michael.tsai@charter.com.