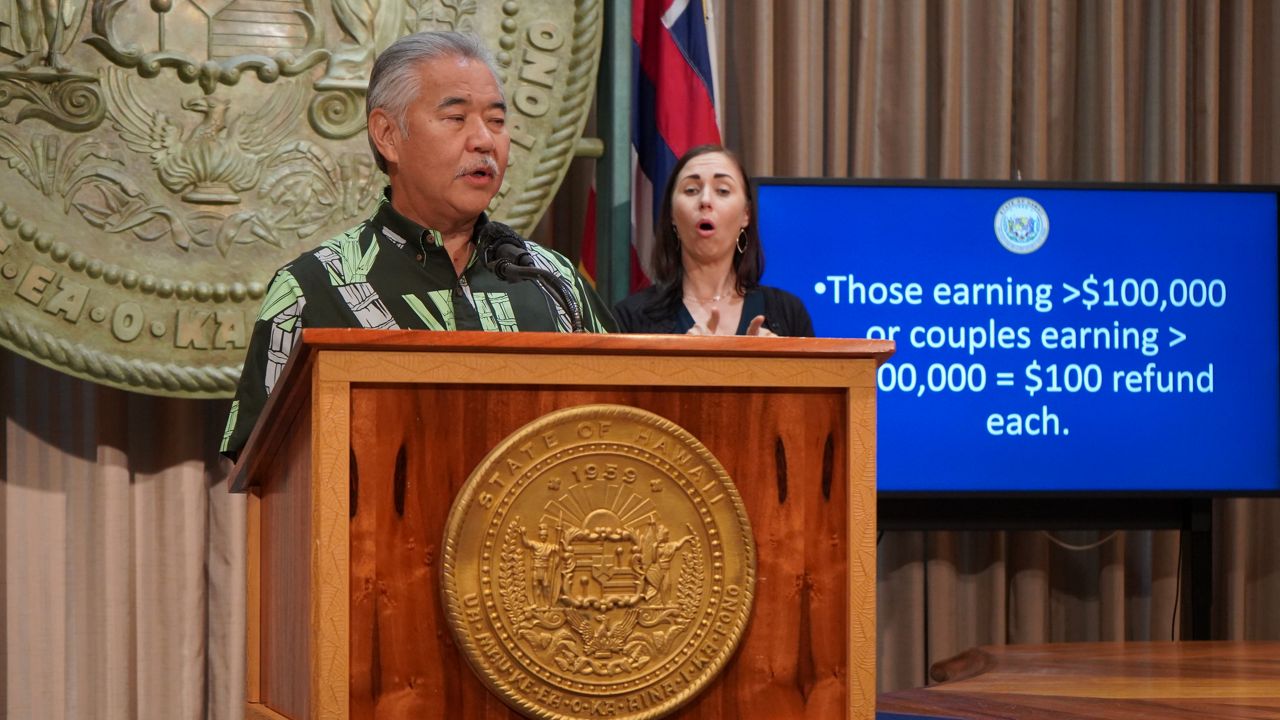

The first of approximately 600,000 Hawaii taxpayers will begin receiving their one-time, constitutionally mandated state tax refunds next week, according to Gov. David Ige.

The governor announced Tuesday that 100,000 taxpayers will receive refunds of $100 or $300 each for themselves and their dependents on or about Sept. 12 in the first of three rounds of direct-deposit distributions.

“It is my hope that the $300 million in tax refunds being distributed so far, bring some relief to the hardworking people of the State of Hawaii who were hit hard by the pandemic,” Ige said.

Under the Hawaii Constitution, the state is required to issue a refund to taxpayers or make a contribution to its rainy day fund if it carries over at least 5% of tax revenue over two consecutive years. Ige, who has served in local politics for more than 30 years, said this year’s refund — about $294 million in total — is the largest he has seen. In previous years, the state has traditionally fulfilled its constitutional requirement by issuing $1 refunds.

Based on current projections, Ige said the state will likely have to issue another refund or make a rainy day fund contribution next year, as well.

For the current distribution, taxpayers who get their refunds via electronic direct deposit will get their one-time refund through the same bank account.

For those who did not opt to receive their regular tax returns via direct deposit, paper check refunds will be mailed in batches of 2,000 while the state waits for additional printed stock used by the state for checks arrives. Once the check stock is available, around the end of the month, paper refunds will increase to 90,000 per week. Those who filed their tax returns by July 31 should receive their refunds by the end of October. Those filing returns after July 31 will receive a refund up to 10 weeks after their filing was received.

About 303,000 direct-deposit refunds and 295,000 paper refunds are scheduled to be distributed so far. Eligible taxpayers must file their 2021 tax returns by Dec. 31 of this year to qualify for this tax refund. Taxpayers who filed individual income tax returns for 2021 and have been residents of Hawaii for at least nine months are eligible for the refund.

Taxpayers earning less than $100,000 per year or couples earning less than $200,000 a year receive $300 each for themselves and their dependents. A qualifying family of four, for example, would receive $1,200.

Taxpayers who earn $100,000 or more per year or couples earning $200,000 or more per year will receive $100 each for themselves and their dependents. In this example, a qualifying family of four would receive $400.

About 535,000 taxpayers, representing just under 90% of all tax returns, filed will get the $300 refund. About 64,000 (11% of returned filed) will get the $100 rebate.

Michael Tsai covers local and state politics for Spectrum News Hawaii.