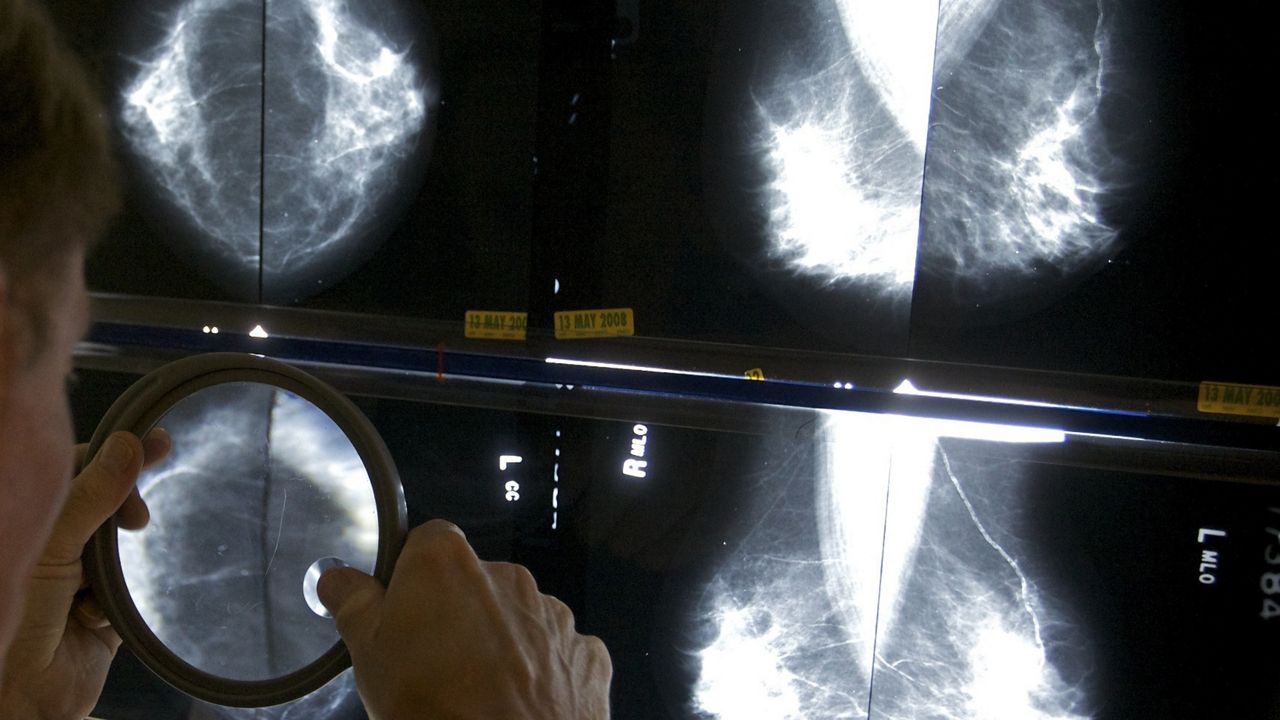

The federal government approved New York's request to create a new tax that's expected to generate billions of dollars in additional Medicaid reimbursement funds for the state, budget officials said Monday.

Earlier this year, the state Legislature applied for a federal waiver to tax Managed Care Organizations the state Health Department pays for Medicaid as part of its last $239 billion budget deal. State leaders applied with the Centers for Medicare & Medicaid Services to create a new funding mechanism for the tax.

Greater New York Health Association CEO Kenneth Raske released a statement Monday announcing that Gov. Kathy Hochul called and told him the federal agency greenlighted the MCO tax.

"This critical development provides a pathway to addressing our dual goals of eliminating health care disparities in vulnerable communities and addressing Medicaid underpayments to hospitals and other providers," Raske said. "I can't think of a btter way to enter the holiday season."

The association removed Raske's statement a few hours later. Hochul has yet to publicly address the approval.

Officials with the state Health Department confirmed the approval Monday, but would not answer questions about how much money it will provide the state and when.

“The department is currently reviewing the final approval,” Health Department spokesperson Danielle De Souza said in a statement. “Additional information will be made available at a later date.”

It remains unclear what will become of the approval after President-elect Donald Trump takes office Jan. 20.

State officials have not released the details about how much money the tax will bring to New York compared to other states.

California instated an MCO tax in April 2023, which is expected to generate $20.9 billion until its expiration on Dec. 31, 2026, according to the California Department of Health Care Services.

This summer, New York businesses and commercial health insurers pushed the governor to leave them out of the new tax if it was approved, warning it could lead to rate increases for employers and employees.