New York Republican lawmakers in the House of Representatives are backing legislation meant to block a proposal in the state budget to shift more than a half billion dollars in Medicaid money from county governments.

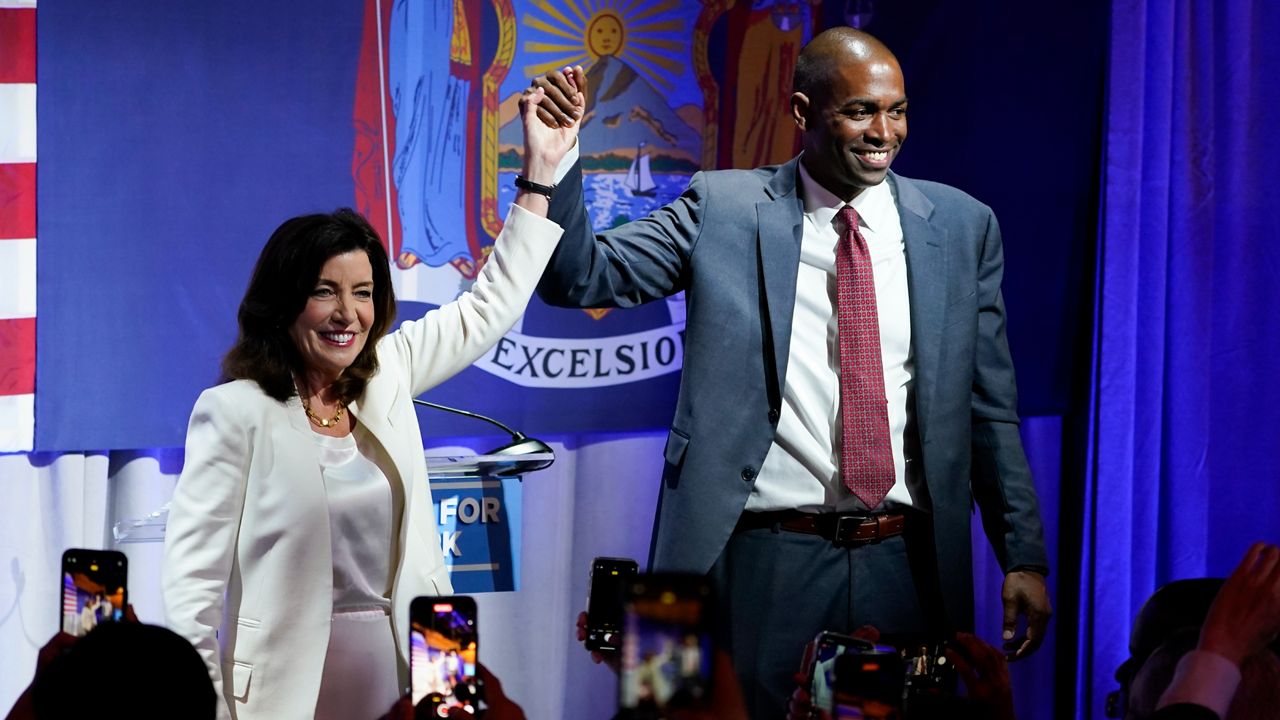

The proposal, to be announced Friday by Rep. Nick Langworthy, is meant to address a provision in Gov. Kathy Hochul's $227 billion budget plan that remains undecided in Albany with a budget now two weeks late.

At issue is cost sharing under the federal Medicaid program, which county governments administer. County governments could lose $281 million in the first year, while $345 million would be swept in New York City.

The money, from the Federal Medical Assistance Percentage funds, is provided to states under the federal Affordable Care Act, which has been used to help offset the cost of expanding the program for county governments.

“This is an outrageous, reckless proposal that would force our already crushing property tax burden even higher,” Langworthy said. “Counties are already struggling under out-of-control state mandates and this would be the death knell for their ability to provide services. These federal funds are dedicated specifically to help cover local government’s costs, not to be used for Kathy Hochul’s slush fund. The Governor and legislature need to get their budget under control and stop the runaway spending that is forcing New Yorkers to leave this state. We need to stand up in Congress and tell the Governor she can’t raid these federal funds.”

Langworthy's proposal is backed by fellow Republicans Reps. Claudia Tenney and Brandon Williams.

Hochul has defended the move amid protests from county governments in New York, who have pointed to potential property tax increases as a result.

In March, the governor said her administration was working with county officials on the issue, but also suggested a larger driver of property taxes, school districts, should consider levy cuts amid record state aid.

"School districts can meet their needs, but also this is an opportunity for them to cut their school taxes," Hochul said at the time.