New York’s main business lobby and advocacy organization on Monday is making a renewed call to have the state government address the $9.6 billion unemployment insurance fund debt in order to ease the burden placed on private-sector firms.

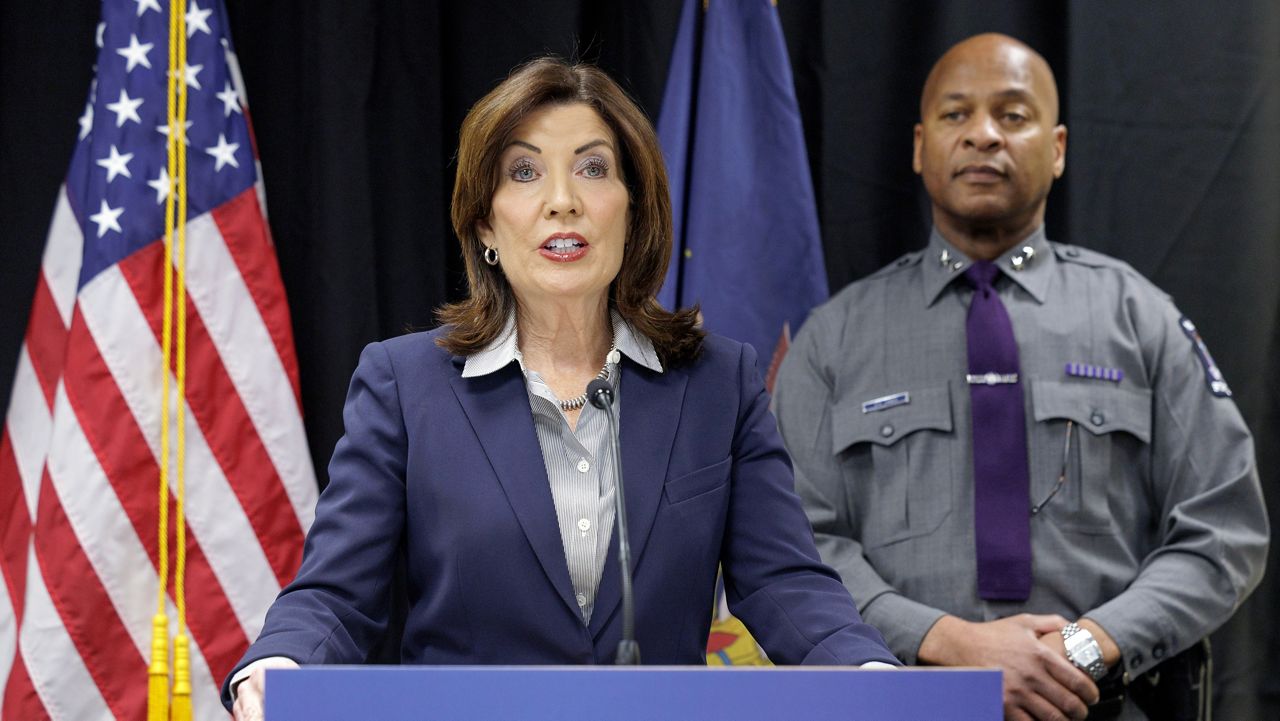

The issue surrounding unemployment insurance debt is still lingering after lawmakers and Gov. Kathy Hochul did not address it in the $220 billion state budget approved last month, and has been an outstanding concern after the pandemic closed many businesses and public gathering spaces.

New York is among nine states that still have an outstanding loan from the federal government, which had been used to cover the historic rise in unemployment claims following the closure in the early weeks of the pandemic.

State requires the unemployment debt and interest generated must be paid back through increased employer payroll taxes in addition to increased federal payroll taxes for unemployment insurance. Those payments would come on top of any taxes paid to keep the unemployment fund whole.

The concern is small businesses will be hit especially hard with the debt payments. New York’s unemployment in the first month of the pandemic hit a double-digit percentage rate as businesses shuttered.

“Minnesota was the most recent state to apply federal pandemic aid to pay down their UI debt and protect their businesses from increased taxes,” said Ken Pokalsky, the vice president of The Business Council. “While we do not expect the state to cover the entire debt, we urge state leaders to dedicate public funds while taking additional measures to provide immediate UI tax relief for employers.”