New York's pension fund is being leveraged by state Comptroller Tom DiNapoli to get changes at companies it invests in, pushing the firms to make stronger efforts to curtail their roles in emitting greenhouse gases and contributing to the changing climate.

The efforts highlighted this week by DiNapoli's office come as the state is moving to phase out the use of fossil fuels in the coming decades and transition to cleaner, more renewable forms of energy.

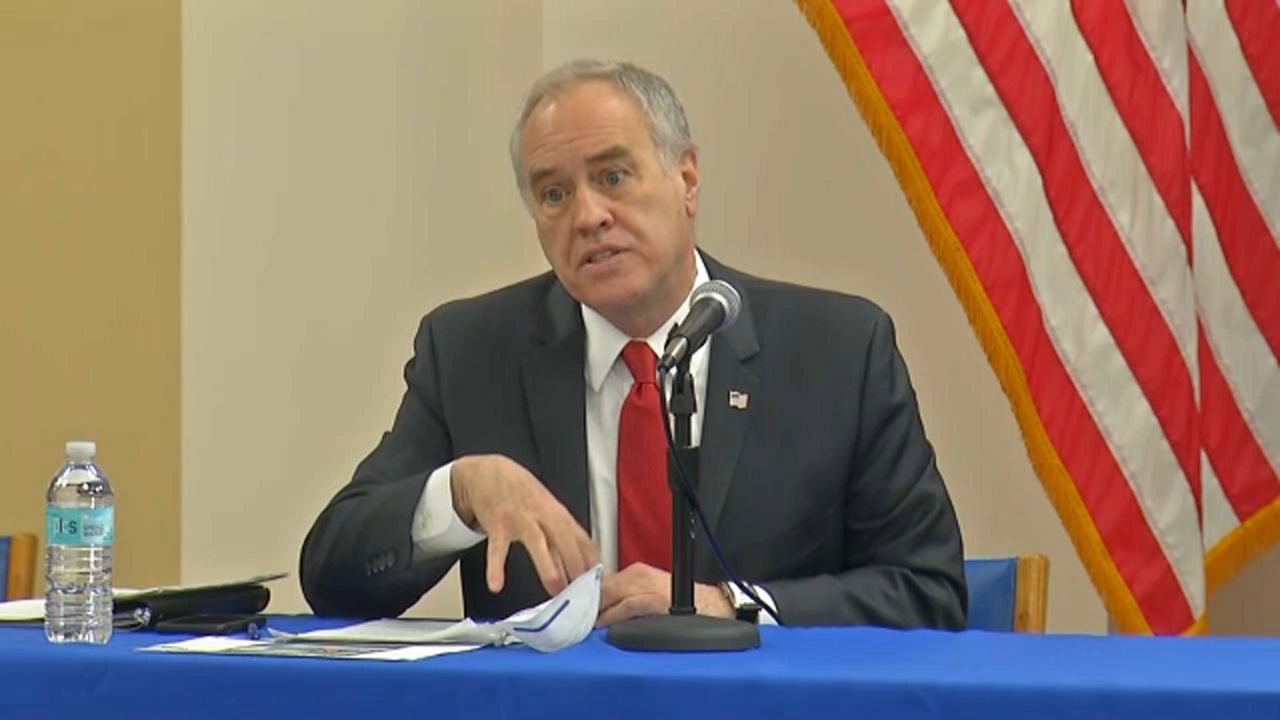

“The climate emergency presents enormous risks and opportunities for investors, but corporate America has to step up, adapt and address the challenges they’re facing,” DiNapoli said. “As the state pension fund’s trustee, it’s my responsibility to protect and strengthen our investments. Making sure our investments — and the retirement security of our 1.1 million members, retirees and beneficiaries — are protected from the impact of climate change is a top priority.”

The push by DiNapoli's office includes filings by the fund to reduce greenhouse gas emissions at Antero Midstream, Eastman Chemical, Eversource Energy, Carnival Corp. and Vulcan Materials.

At the same time, DiNapoli is calling for better reporting of environmental jusice at Chemours and 3M, while also strengthening physical risk reporting at Google's parent company Alphabet and The J.M. Smucker Company.

And the pension fund through the comptroller's office has signaled it would vote against the election of directors to corporate boards if the companies fail to address climate change-related issues.

The fund has been able to use its leverage in the past to boost political giving transparency at firms it invests in. The fund as of the end of December was valued at more than $279 billion.

In the years since DiNapoli took office, the pension fund has filed more than 160 climate change-related shareholder resolutions and reached 81 agreements with companies in its portfolio meant to reduce greenhouse gas emissions.