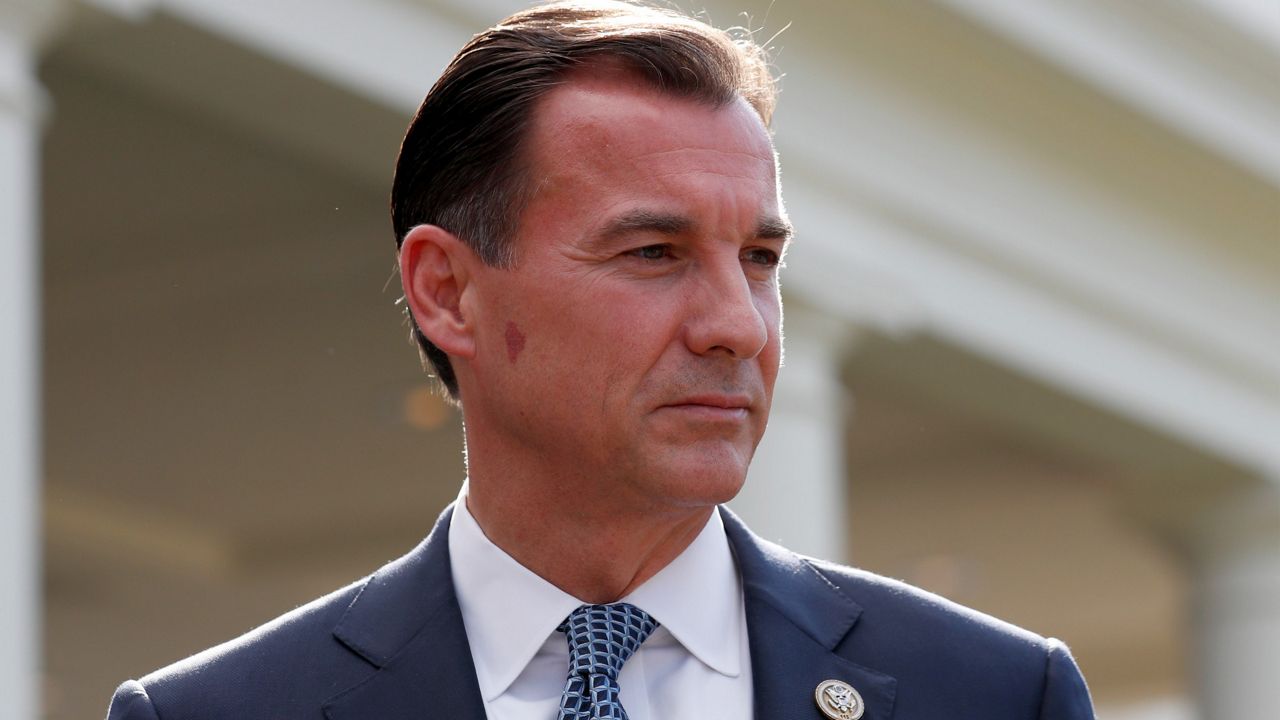

For months, U.S. Rep. Tom Suozzi by his own admission sounded like a broken record with the mantra of "no SALT, no deal."

And Suozzi got his deal on altering the $10,000 cap on state and local tax deductions as a provision in the Build Back Better Act approved Friday by the House of Representatives. The provision comes as Suozzi, a Long Island Democrat, is openly eyeing a campaign for governor, and could enter the race later this month.

The provision in the bill does not end the cap entirely, but phases it up from $10,000 to $80,000 over the next decade. The cap was put in place in 2017 as part of a Republican-backed tax cut package and largely affects high tax states like New York, New Jersey, California and Illinois.

Suozzi built a coalition of lawmakers from those states to call for the SALT changes in the bill and withheld their support until it came.

“This agreement to substantially raise the cap from $10,000 to $80,000 will help millions of New Yorkers keep billions of dollars in their own pockets,” said Suozzi. "If passed in the Senate, New York's families will see this immediate relief when they file their 2021 income tax in April. This is a major step forward in our relentless pursuit to protect New York taxpayers."

The deal must still pass in the U.S. Senate, where Republicans are sure to oppose it and Democrats have been skeptical. Given the narrow divide in the chamber, Democrats cannot lose a single member on the bill.

Suozzi's office on Friday pointed, however, to the broad support for the phase up of the SALT cap, coming from the U.S. Conference of Mayors, the American Federation of Teachers, the International Association of Fire Fighters and local governments.

"The uncapped SALT deduction was established 150 years ago to create fairness between high and low-cost states," said New York State Association of Counties Executive Director Stephen Acquario. "It represents the very essence of the Republic and its taxpayers at the federal, state and local level and how policies are funded and services provided. The Association thanks Congressman Suozzi, and the entire NY Congressional Delegation for their steadfast efforts to restore this provision in the American Tax Code."