ST. LOUIS — As the 2023-24 academic year is around the corner, the Missouri back-to-school sales tax holiday is this weekend, Aug. 4-6. Cities that have opted from participating locally in the past will not have the option beginning this year.

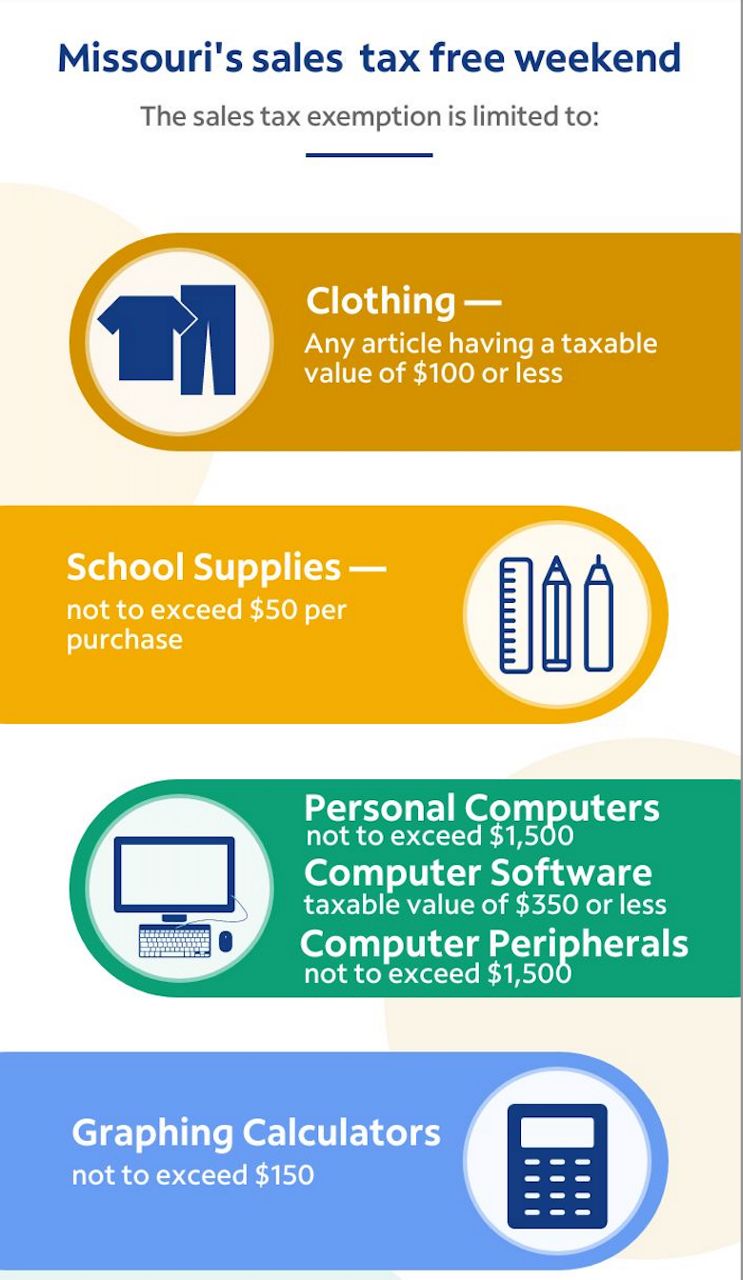

Back-to-school items that are exempt from state and local sales tax during the three-day period include clothing, school supplies, personal computers, computer software, graphing calculators and more. For more information on sales tax holiday items, click here.

St. Louis area municipalities and the rest of the state will participate in Missouri’s sales tax-free weekend. The state and local sales taxes will be waived during the three-day period.

Cities such as Des Peres, Brentwood, Frontenac, Richmond Heights, St. Peters, among others, that opted out in the past are now required to participate due to the passage of SB 153.

The Fenton Chamber of Commerce is reminding followers to shop local this weekend, reminding people all municipalities will be participating this year.

The Missouri Higher Education & Workforce Development estimates $41.5 billion will be spent on back-to-school shopping for grades K-12 nationwide with an average household expected to spend $890. An estimated $94 billion will be spent on back-to-school shopping for college students nationwide with an average house expected to spend $1,367.