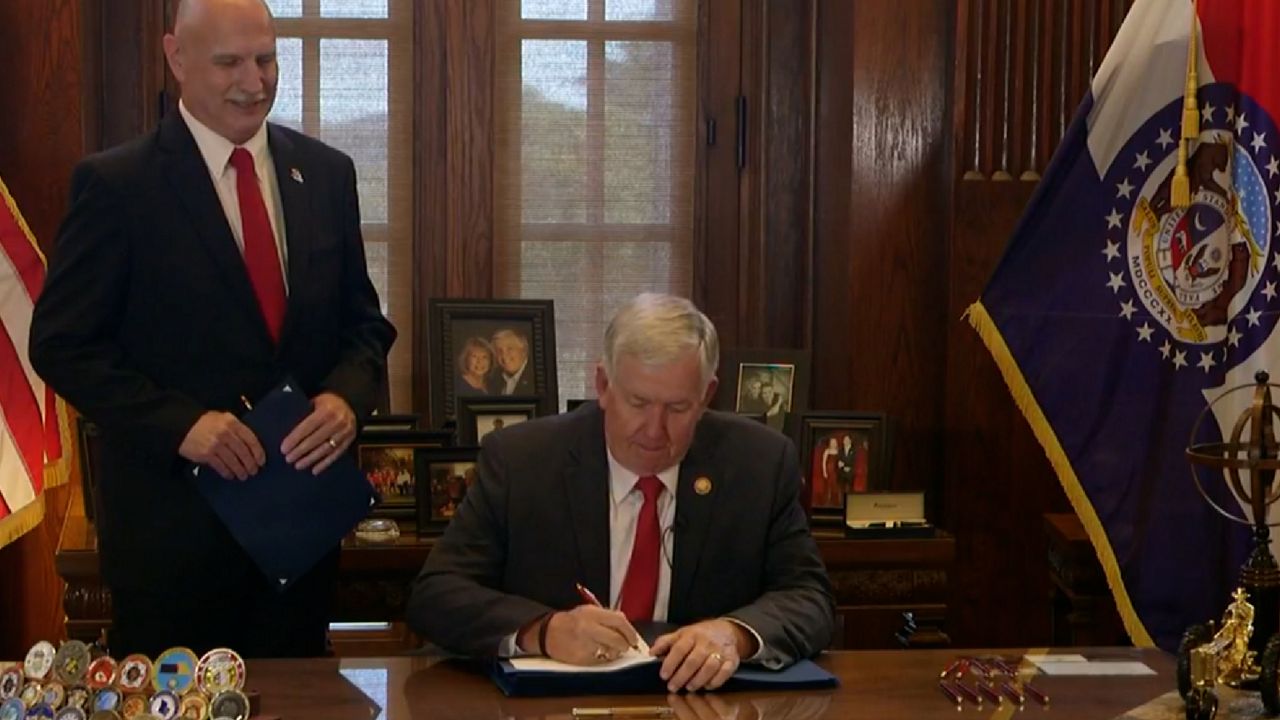

Missouri Governor Mike Parson on Wednesday signed legislation passed in the just-concluded special session which will spend roughly $760 million on permanent income tax cuts and $40 million annually over the next six years for agriculture tax credits.

Under the new law, income taxes will be cut from 5.3% to 4.95% beginning next year and phase in additional cuts until the rate hits 4.5%. The bill applies to the top income tax rate, which covers those who make more than about $8,700 a year in taxable income. The additional cuts would be triggered by revenue growth benchmarks tied to inflation.

The measure also eliminates the lowest tax bracket, meaning earners who bring in less than about $1,000 a year no longer will have to pay state income taxes. Taxpayers who make between $22,000 and $66,000 a year would on average see savings of between $10 and $50 next year because of the income tax cut, according to an analysis by the Missouri Budget Project. The organization analyzes state budget policy and its impact on low-income families.

Once the income tax rate hits 4.5%, savings for those workers would amount to roughly $29 to $131 a year on average, according to the same analysis.

Earners who make $66,000 to $110,000 a year would on average see about $120 in immediate savings and $275 per year in savings once the full tax cuts kick in.

And taxpayers who make about $1.6 million per year would save roughly $4,200 next year and $9,500 per year once the bill is fully implemented.

Democrats and some Republicans criticized the measure as favoring wealthier Missourians while doing little for low-income families and retired workers on fixed incomes.

Parson Wednesday defended the cut, calling it balanced and fiscally responsible and coming at a time of record spending for education and infrastructure.

More than two dozen other states have passed or are considering tax cuts or rebates in response to an outpouring of federal pandemic aid and their own surging tax revenue.

The bill Missouri lawmakers passed represents a compromise between Republican senators who wanted even deeper tax cuts and those worried about cutting so much that government services might need to be slashed if future revenue collections are not as strong. It does not include an increase to the standard deduction.

Legislators Tuesday finished work on agriculture tax incentives that were signed into law Wednesday. Parson vetoed similar legislation passed during the regular session, which ended in in May, citing two-year sunset provisions which he said didn’t give the programs enough time to prove effective, or allow for enough planning time.