ST. LOUIS – Last Friday’s 2.8 magnitude earthquake centered in St. Louis County served as a reminder to many that quakes can happen in Missouri. A new report shows earthquake insurance coverage has dropped across the state, and in southwest Missouri’s New Madrid Region — the highest risk part of the state — it has reached an historic low.

The Missouri Department of Commerce and Insurance (DCI) issued a new Earthquake Insurance Market Report showing only 11.4% of residences in the New Madrid Region have earthquake insurance, down 49% between 2000 and 2021.

DCI says price and lack of availability of insurance are likely major factors for the drop in coverage, but another reason is people in that high-risk area didn’t realize earthquake coverage is not part of their homeowners’ policy.

Dave Bissell, with Insurance Advisors of St. Louis, says he doesn’t know of many insurance companies writing policies in the New Madrid area because of the risk there. He says there are even a few insurance companies that won’t cover earthquakes in any location.

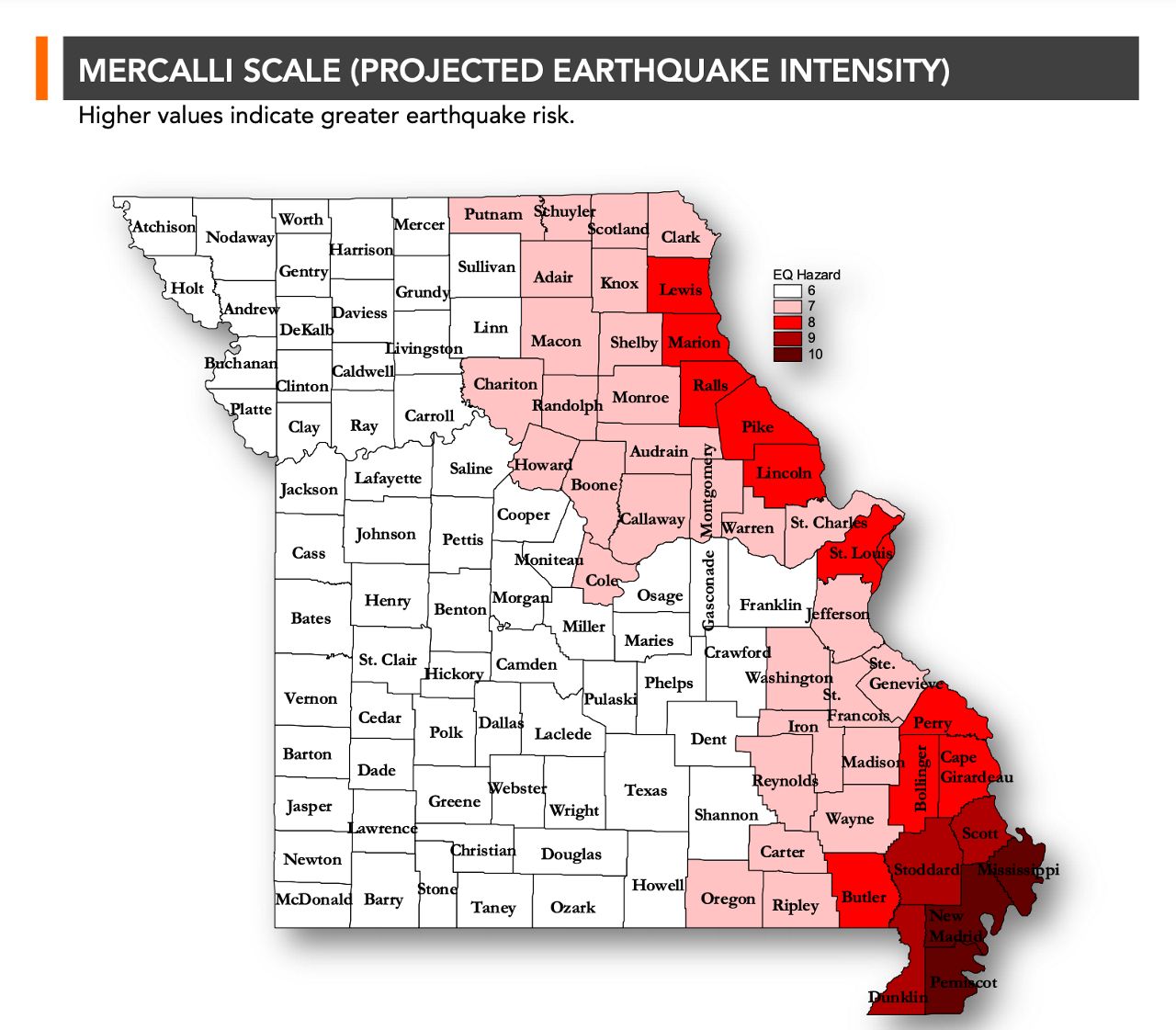

Last week’s earthquake occurred in the Ozark Dome Region, not the New Madrid Seismic Zone, but the state report says the highest risk area from the New Madrid Region extends from the bootheel up the Mississippi River to the St. Louis metro area.

It’s not just the New Madrid Region that has seen a drop in earthquake coverage. The state report shows in 2021, 46% of dwellings have earthquake coverage in St. Louis, a drop of nearly 15% since 2000. St. Charles County is the only county in the state where at least half the residences are insured from damage caused by earthquakes, and that is still a 14% drop since 2000. In Jefferson County, 48% of dwellings are covered, an 11% drop during that same time period.

Bissell says his agency always offers earthquake policies with all quotes and says 85 to 90% of the customers he works carry earthquake coverage. He says a policy in this area is relatively inexpensive, especially if you have a framed home. Bissell says the brick homes, popular in St. Louis City, may cost more to cover, or not be covered at all.

Cost

There also has been a jump in the cost for coverage across the state. In the New Madrid Region, earthquake insurance has increased 816% since 2000. On average, coverage in that region was an average of $524 annually in 2021.

The coverage cost has jumped 347% to an average of $283 a year for those living in “other high-risk counties” like St. Louis.

In St. Louis County, the average premium is $285 a year. Residents in St. Charles County will spend about $257 a year on earthquake coverage, and in Jefferson County, the premium is about $216.

Bissell points out, earthquake policies usually carry a deductible as a percentage of the value of insured property. He says that can add up fast for a homeowner. For example, if you purchase a policy on a $200,000 home with a 10% deductible, the homeowner would have to cover the first $20,000 of damage to the insured property.

DCI officials say despite yearly campaigns to raise awareness, the gap between the insured and uninsured continues to grow. A summit will be held later this month to start a conversation to solve this issue.