CLEVELAND — For the first time since in more than five years, the federal government will resume collections on student loans that are in default starting on May 5.

“This is a deeply individual, localized problem," Phil Wallace said. "This affects our neighbors. This affects our family. This affects our loved ones. The reason why you’d want to start taking action now would be because of the involuntary collections.”

Wallace is the director of adult programs and services for College Now Greater Cleveland, a nonprofit that offers guidance on student loans. He says if defaulted borrowers don’t deal with the problem, the consequences could be significant.

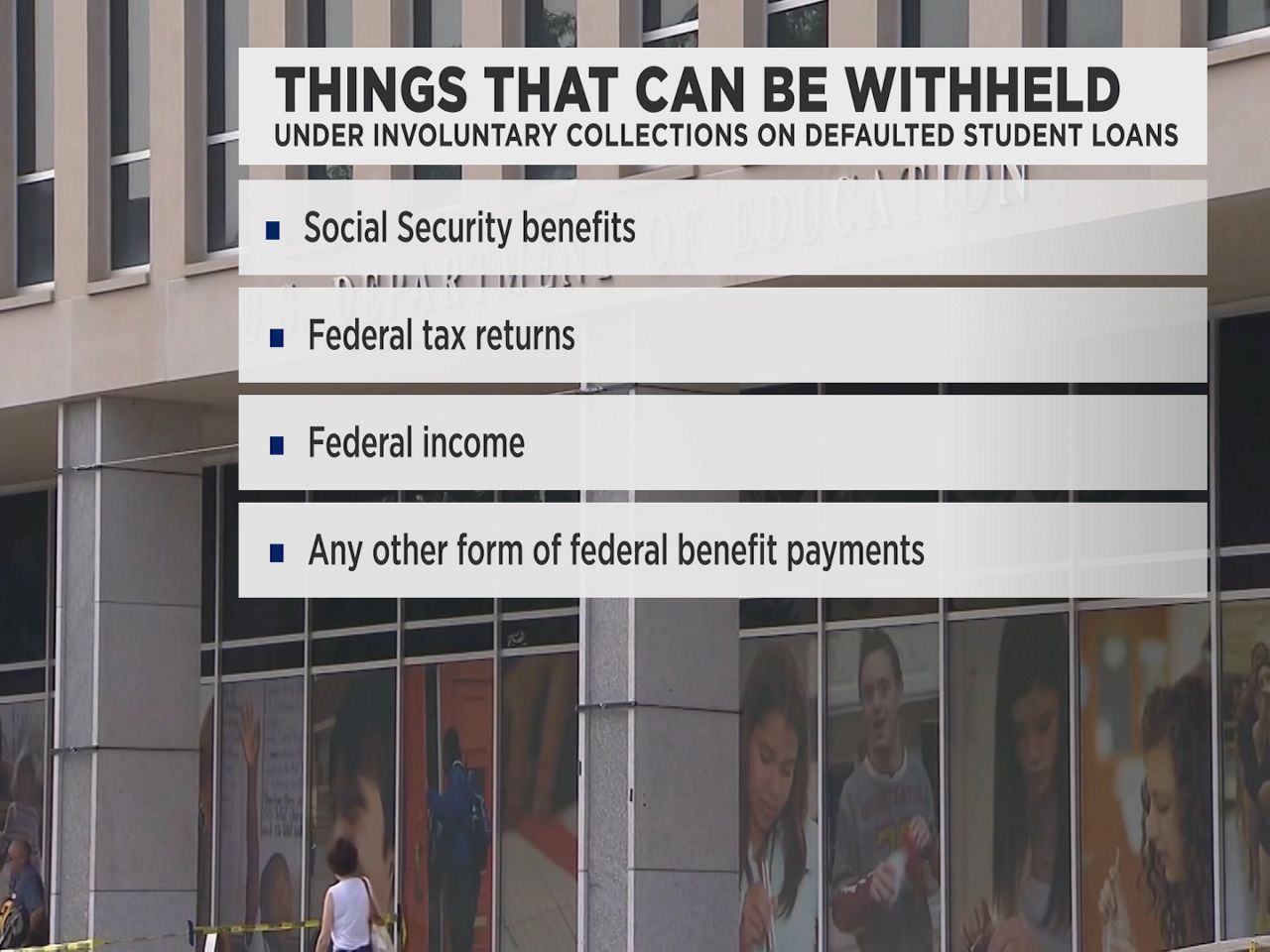

“If you’re receiving social security benefits, if you’re awaiting a tax refund, any other money that you would expect to receive from the federal government they would start to collect that first," Wallace said. "Long story short it is a good idea to take action. They seem to be pretty serious about these collections this time around.”

The first thing borrowers need to do is check if their loan is in default, which means payments haven’t been made for 270 days. You can do that by logging onto studentaid.gov.

From there, Wallace says the best option is to apply for loan rehabilitation.

"This is probably the preferred way to go," said Wallace. "If you have not done it yet. If you have already done this at any point in your life, you would not be eligible to do this.”

Betsy Mayotte is the founder and President of the Institute of Student Loan Advisors and has worked in the student loan industry for over 20 years. She says the reason loan rehabilitation is the preferred option for borrowers in default is because it would not impact your credit score once the proccess is completed.

“Rehabilitation means making nine consecutive on time payments usually based on your income and family size," Mayotte said. "The involuntary collections will no longer be a threat to you either, and your credit report will show that the loan is no longer in default.”

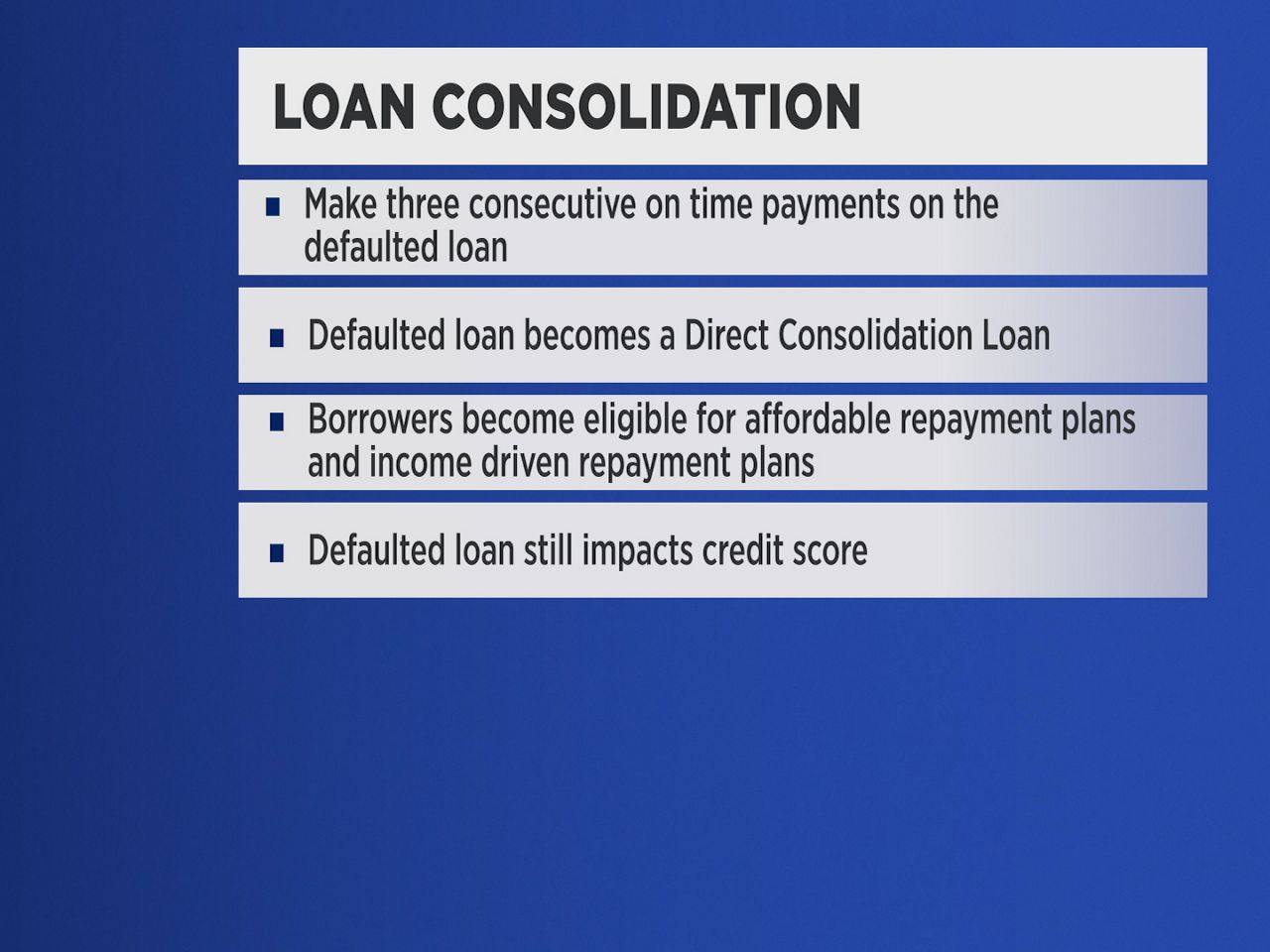

Loan consolidation is another option which involves making three consecutive on time payments and becoming eligible for an income driven repayment plan, but the defaulted loan would still impact your credit score. Mayotte says whatever avenue borrowers in default take, the time is now to act.

“There are a lot of different borrowers that are like, 'I can’t afford to make payments, but the thing is you can’t afford not to,'" Mayotte said. "They can take up to 15% of your income with the wage garnishment.”

According to the Department of Education, there are more than 5 million student loan borrowers in default status. Sixty-two percent of all borrowers are in some sort of late-stage delinquency, meaning default status could soon follow. Wallace wants to remind borrowers here in Ohio that they’re not alone in this process.

“We’re here to help those in the greater Cleveland area figure out this situation," he said. "We just want you to know that you’re not alone and you do have support in this.”

Defaulted student loan borrowers should receive notice over the next two weeks if they’re in danger of the involuntary collections. Wage garnishment would not start right away. Those impacted should get 30 days’ notice before that would begin.