WASHINGTON — The federal government is likely to run out of money to pay its bills between mid-July and early October, the Bipartisan Policy Center said Monday.

The so-called "X Date," when the U.S. Treasury is no longer able to fulfill its existing financial obligations on time and in full, is based on expected tax revenues, U.S. economic strength, new tariff revenue, congressional spending and U.S. DOGE Service impacts.

The Washington, D.C., think tank encouraged Congress to either suspend or increase the country’s debt ceiling before the Treasury Department runs out of money. The congressionally imposed limit restricts the government from borrowing money to meet its financial obligations.

“Fiscal responsibility is not just about avoiding financial calamity time and time again — it’s about ensuring economic stability and paying our bills on time,” Bipartisan Policy Center President Margaret Spelling said in a statement Monday.

She said 2025 “presents many opportunities to begin getting our fiscal house in order without risking the full faith and credit of the United States. Policymakers must commit to responsible budgeting, which starts with avoiding debt limit brinksmanship and its impacts on our economy.”

The last time Congress suspended the debt limit was in June 2023 as part of the Fiscal Responsibility Act, which allowed the federal government to borrow as much as it needed through Jan. 1, 2025, to meet its financial obligations.

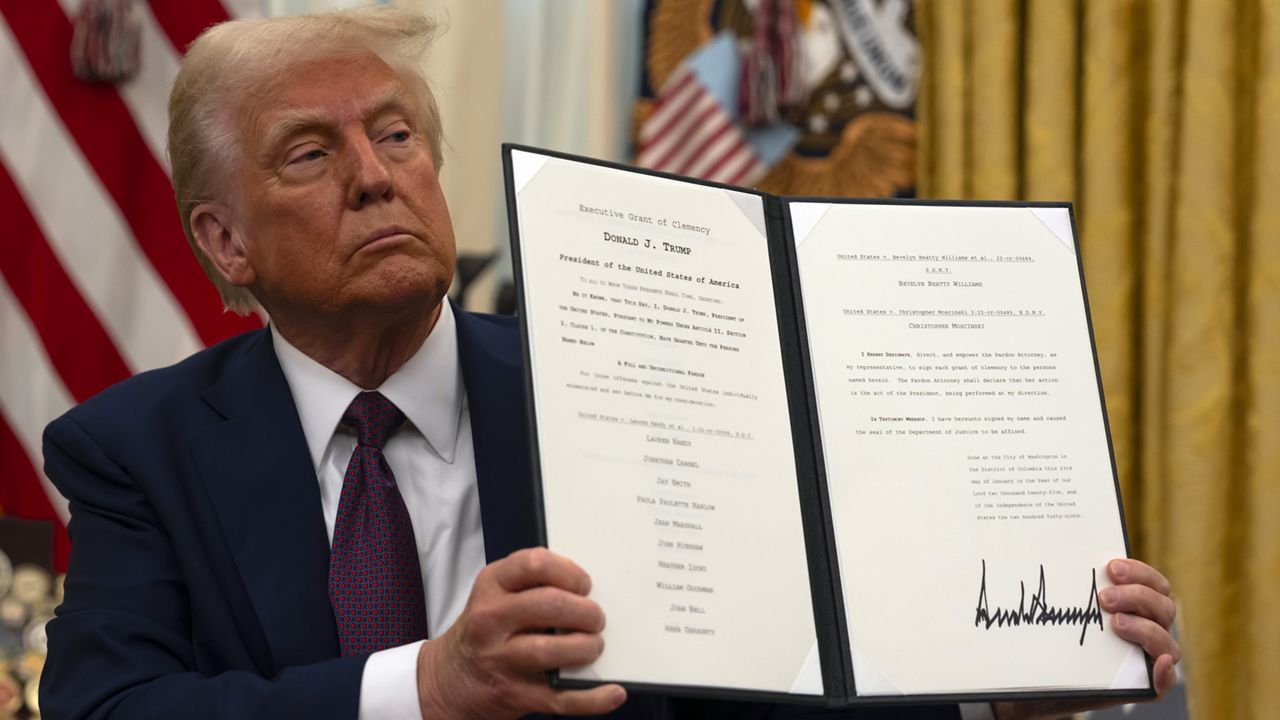

Less than a week after that debt ceiling suspension expired, then-President-elect Donald Trump said he wanted Congress to eliminate the federal debt limit entirely.

The national debt currently exceeds $36 trillion and is likely to grow as Trump pursues an extension of the tax cuts he implemented during his first term. Last month, House Republicans approved a federal budget blueprint that included $4.5 trillion in tax breaks and $2 trillion in spending cuts.

The Bipartisan Policy Center said uncertainty over when lawmakers take action on the debt limit will cause economic instability, including market volatility, higher borrowing costs and reduced confidence in U.S. fiscal stability.