Lawmakers will consider changing state law to make economic development projects and state tax subsidy programs more transparent after good-government group Reinvent Albany released a report recommending significant reforms to change the structure of the related state agency and improve its public oversight.

The report puts pressure on lawmakers to change state law and force economic development programs to publicize more data and improve their accountability — a conversation beginning as the state is expected to shoulder a more than $9 billion budget gap next year, and lawmakers begin to look for places to close that deficit.

"The public authority in general is very secretive," said Elizabeth Marcello, a senior research analyst with Reinvent Albany. "They don't tell you a lot of information about subsidy deals, the set cost per job and what are the financial assumptions underlying why this company is getting subsidies and not this company."

The new report highlights concerns about the transparency of Empire State Development — or the state's economic development agency — met with Reinvent Albany.

The state and local governments spend about $11 billion a year on economic development combined, according to the Citizens Budget Commission last week.

Marcello says the amount of money invested in tax incentive and subsidy programs don't provide a good return on their investment.

"Anything could be economic development," she said of ESD's scope. "It could take any project that the governor dreams up and it has to take it on."

ESD projects fail to make much information public and are susceptible to corruption, Marcello added.

ESD expanded a public database of information about its economic incentive projects, but the report criticizes the tool for not showing how much in subsidies a business has received annually or a larger picture of how funds are spent.

"Reinvent Albany is reinventing the facts," ESD spokeswoman Kristin Devoe said in a statement Friday. "From a historic $100 billion investment by Micron unlocking tens of thousands jobs, to pandemic relief funding that supported more than 40,000 small businesses, ESD is continuing to support the state’s growth in a way that attracts 21st Century businesses from fast-growing sectors, creates and protects critical jobs and moves the economy forward.”

ESD projects have retained and created more than 174,000 jobs statewide since 2018, generating $27.1 billion in private-sector investment, according to the department.

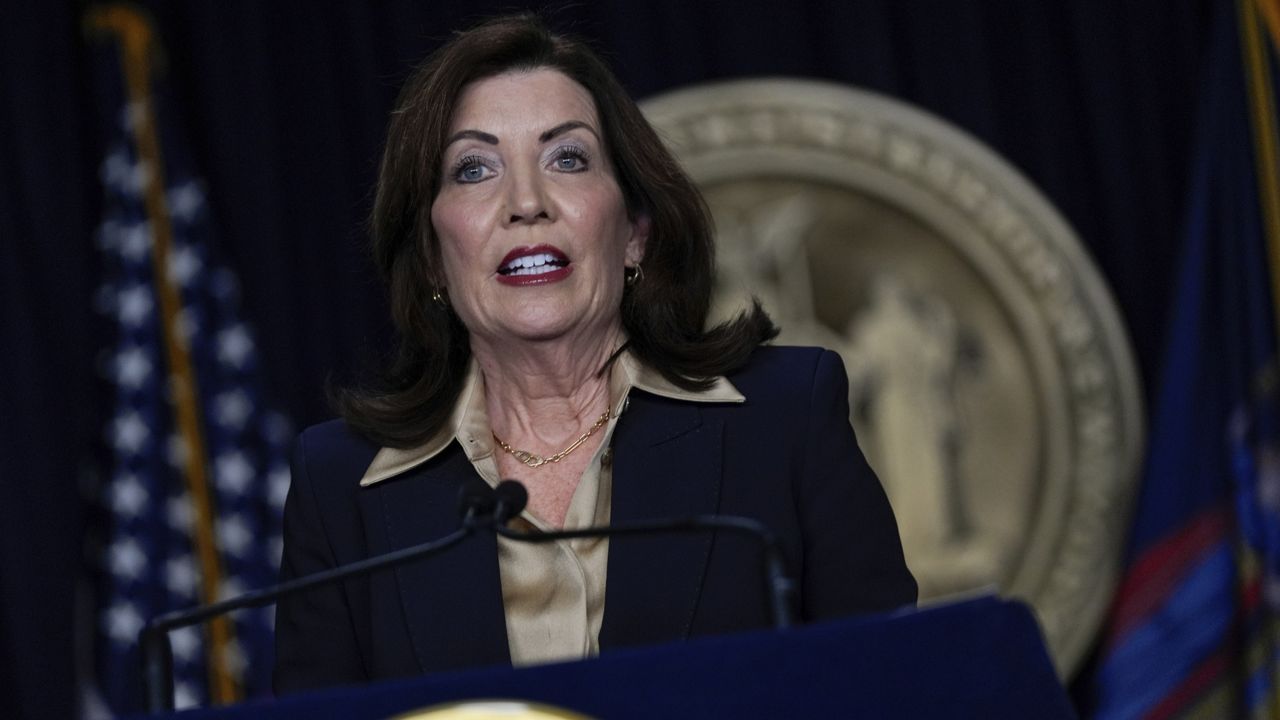

Department officials also tout launching a new webpage dedicated to ESD transparency efforts, and holding about 100 public meetings in the nearly two years since Gov. Kathy Hochul took office. ESD issues more than 50 annual and quarterly program reports, which the department says have been issued more expediently under Hochul.

Advocates want to reform the structure of ESD and empower the Authorities Budget Office and the state comptroller to conduct more oversight and other changes.

"We're really setting the stage for what I hope will finally be a banner year where we can reform economic development here in New York," said Sen. James Skoufis, a Democrat from Woodbury.

Skoufis, who chairs the Investigations and Government Operations Committee, carries a bill to require economic development entities be subject to the Open Meetings and Freedom of Information Laws and mandates financial disclosures from members.

An independent firm is working to complete an audit of the state's major economic development programs, included in last year's budget. It's expected to be completed by the end of the year.

Skoufis said he'll use the recommendations from the audit and Reinvent Albany's assessment to introduce proposals for other reforms next session.

"The stage will finally be set for the Legislature to really enact true, meaningful reform, do away with the spending that's not working and make transparent all of the dollars and cents that are flowing into these projects," the senator said.

Lawmakers have much to consider with the state comptroller estimating a budget gap of more than $36 billion over the next three years.

In the last state budget, Hochul invested millions more dollars in the state's film and entertainment tax credits, and other incentive programs questioned for their efficacy.

Empire Center for Public Policy research director Ken Girardin agrees it's an area of the budget that must be scrutinized.

"Every dollar that the state gives away to the entertainment industry is either a dollar of taxes that it needs to collect or a dollar of services that it can't provide," he said.