A $1.9 trillion COVID-19 relief stimulus package is set to finish passing through the U.S. House of Representatives this week.

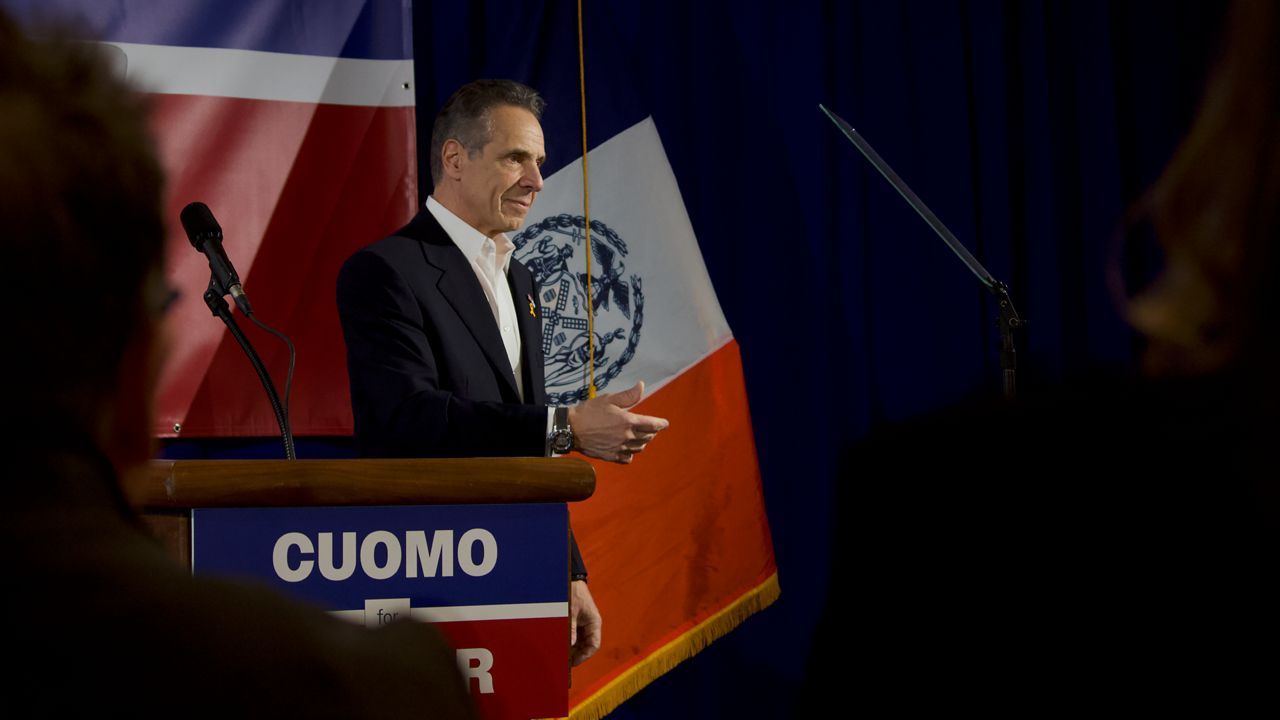

New York state is set to receive around $12.5 billion in direct aid out of this package, but Governor Andrew Cuomo signaled on Sunday that this still will not be enough to keep the state from having to increase taxes.

“This budget is going to raise two big questions,” Gov. Cuomo said during a press call. “It's going to raise the question of taxes, how much do you need to raise in tax revenue given the federal bill, and what are the smartest and best ways to raise revenue?”

However, looking back, Cuomo’s support for raising taxes has been hazy. In the past, the governor has been staunchly against a tax increase of any kind.

Then COVID-19 costs started to pile up, the state was projecting low-tax receipts for years to come, and federal relief was stalled in Congress, and so the idea started to gain more traction.

Even still, Cuomo at the beginning of the year made it seem that tax increases would be dependent on how much money the state would receive in federal aid, saying the state needed at least $15 billion in direct relief.

“If we have the federal money, there isn’t a need to raise those taxes,” Budget Director Robert Mujica told reporters after Cuomo unveiled his $193 billion executive budget back in January.

Now that the state fell just short of receiving that $15 billion, Cuomo said a tax increase, already phased into his January budget proposal, is most likely still needed to fill in that gap.

“This does not mean this is going to be an easy budget. It means it is now a possible budget,” Cuomo said after news broke the latest stimulus package passed the U.S. Senate. “Not an easy budget. Why? You still have tremendous needs that COVID created. Rent needs, assistance needs, daycare needs, job and employment needs, so you have tremendous needs.”

Yet, conservative fiscal groups argue that since the state’s revenue and economic forecast is much higher than projected, a tax increase is not needed.

EJ McMahon with the Empire Center, a right leaning think tank, said although these federal dollars are a one-time investment, it is still more than what the state needs.

“What’s now confused is what are you going to do with it? Because he has spent so many months now confusing people talking about a $15 billion deficit and how we’re deeply in the hole that he is finding it increasingly hard to hide the fact that, very temporarily, they are swimming in cash,” McMahon explained.

A growing number of Democratic lawmakers are in support of raising taxes on the wealthy in order to help supplement education funding, rental assistance, mental health services, and more.

Majority leaders in both houses have signaled support on increasing taxes, but have yet to back a specific proposal. For this reason, some lawmakers are wary of the continued support Cuomo has shown for increasing taxes.

Now that Cuomo is battling numerous sexual harassment allegations and calls for resignation by many progressive Democrats, the same Democrats also backing an increased tax on the wealthy, some wonder if Cuomo is sticking with this tax proposal to placate some of his critics.

Assemblyman Tom Abinanti, who has been calling on Cuomo to resign, said, in the end, it doesn’t matter.

“There are some people who have been saying the governor is going to be a lot more cooperative in the budget process because of the other distractions that he is going through,” Assemblyman Abinanti said. “I will take it. Whatever makes this governor more attentive to the needs of the people of the state of New York is okay with me.”

One-house budget proposals are due next week in the Legislature.